Secure Business Credit Cards for Businesses with Limited Credit History

Secure business credit cards for businesses with limited credit history offer a crucial pathway to financial stability and growth. Many entrepreneurs face the challenge of establishing business credit, especially when starting out. This guide navigates the complexities of securing such cards, offering strategies for building credit, selecting the right card, and managing finances responsibly. We’ll explore various financing options and provide practical advice to help your business thrive.

Building business credit is vital for accessing loans, securing favorable terms with vendors, and demonstrating financial responsibility. However, for new businesses or those with less-than-perfect credit, obtaining traditional financing can be difficult. Secured business credit cards provide a viable alternative, allowing businesses to establish a credit history and improve their financial standing over time. This guide will detail the process, from choosing the right card to effectively managing your credit and exploring other funding avenues.

Understanding Business Credit and Limited History: Secure Business Credit Cards For Businesses With Limited Credit History

Building business credit, especially when starting out, can feel like navigating a maze. Understanding the differences between personal and business credit, and the factors affecting your business credit score, is crucial for securing financing and achieving your business goals. This section will clarify these key aspects and help you understand how to build a strong credit profile for your business.

Personal credit and business credit are distinct entities. Your personal credit score, based on your individual financial history (loans, credit cards, etc.), is separate from your business credit score. Lenders use your business credit report to assess the creditworthiness of your company, considering factors like payment history, debt levels, and length of credit history. While your personal credit might influence your ability to secure initial business financing, building a separate business credit profile is essential for long-term financial success.

Strong business credit allows you to access better loan terms, higher credit limits, and more favorable vendor relationships.

Factors Impacting Credit Scores for New Businesses

Several factors significantly impact a new business’s credit score. These include timely payment of all business obligations, maintaining low debt utilization ratios, establishing diverse credit accounts, and demonstrating a consistent business operating history. Lenders look for evidence of responsible financial management. A history of missed payments, high debt levels relative to revenue, or a lack of credit diversity can negatively impact your score.

Conversely, consistent on-time payments and responsible credit utilization demonstrate financial stability and increase your creditworthiness.

Common Reasons for Limited Business Credit History

Many new businesses initially struggle with limited credit history. This is often due to the time it takes to establish credit relationships with vendors and lenders. Other reasons include infrequent credit applications, a lack of business credit accounts, and insufficient business revenue to support larger credit lines. Some businesses might also prioritize building personal credit first, delaying the process of establishing separate business credit.

Understanding these common hurdles is the first step to overcoming them.

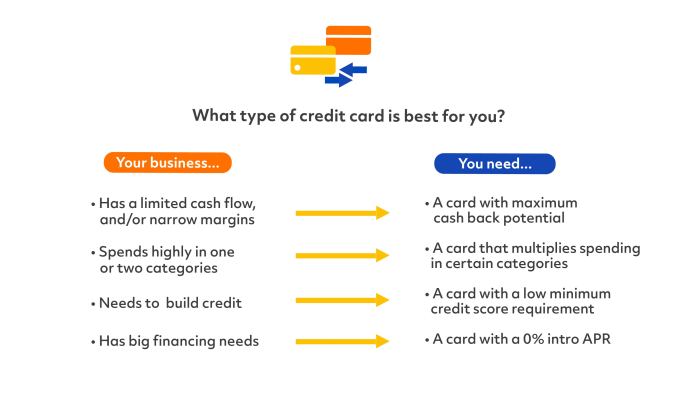

Comparison of Business Credit Card Types

The table below Artikels the key differences between common types of business credit cards. Choosing the right card depends on your business’s specific needs and financial situation.

| Type | Credit History Required | Benefits | Drawbacks |

|---|---|---|---|

| Secured | Minimal to none | Easier to qualify for, builds business credit | Requires a security deposit, lower credit limits |

| Unsecured | Established business credit history, strong personal credit | Higher credit limits, potentially better rewards | Higher risk of rejection if credit history is weak |

| Rewards | Varies depending on issuer and card type | Cash back, points, miles, other perks | May have higher interest rates or annual fees |

Securing a Business Credit Card with Limited History

Building business credit when you’re starting out can feel like an uphill battle. Many lenders require a proven track record, leaving new businesses struggling to access the financial tools they need. However, securing a business credit card, even with limited history, is achievable with the right approach and understanding of available options. This section explores strategies to expedite credit building, Artikels alternative financing solutions, and details the advantages, disadvantages, and application process for secured business credit cards.

Strategies for Building Business Credit Quickly and Effectively

Establishing business credit rapidly requires a multi-pronged strategy focused on demonstrating financial responsibility and stability. This involves more than just applying for credit; it’s about creating a positive credit profile. Consistent, on-time payments are paramount. Consider these steps:

- Obtain an EIN: An Employer Identification Number (EIN) from the IRS is crucial. It separates your business finances from your personal finances, a key step for establishing independent business credit.

- Register your business: Formal registration with your state provides legitimacy and contributes to a more robust credit profile. This demonstrates a commitment to your business.

- Establish business lines of credit: Explore options like vendor credit accounts (paying suppliers promptly) or small business loans from credit unions or community banks, which can help build credit history faster than credit cards alone.

- Monitor your business credit reports: Regularly check your reports from major business credit bureaus (Dun & Bradstreet, Experian, Equifax) to identify and correct any inaccuracies that could negatively impact your score.

- Use a secured credit card: A secured business credit card, discussed in more detail below, can be a good starting point. Responsible use, including paying on time and keeping balances low, can significantly boost your creditworthiness.

Alternative Financing Options for Businesses with Poor Credit

If securing a traditional business credit card proves challenging due to poor credit, several alternative financing options exist. These alternatives may have higher interest rates or stricter terms, but they can provide necessary capital for growth.

- Microloans: Smaller loans from organizations like the Small Business Administration (SBA) or community development financial institutions (CDFIs) can be easier to obtain with limited credit history.

- Invoice financing: This option provides immediate cash flow by advancing a percentage of your outstanding invoices. It’s useful for businesses with consistent sales but slow-paying clients.

- Merchant cash advances: These advances are based on future credit card sales, providing a lump sum in exchange for a percentage of future transactions. They are typically more expensive than traditional loans.

- Peer-to-peer lending: Online platforms connect businesses with individual investors willing to provide loans. Interest rates can vary depending on the borrower’s creditworthiness.

Advantages and Disadvantages of Secured Business Credit Cards

Secured business credit cards require a security deposit, which acts as collateral. This reduces the lender’s risk, making them more accessible to businesses with limited credit history.

- Advantages: Easier approval, credit history building, potential for higher credit limits over time, helps establish business credit.

- Disadvantages: Requires a security deposit (which can be substantial), potentially lower credit limits than unsecured cards, interest rates may be higher than unsecured options.

Application Process for Secured Business Credit Cards

The application process for a secured business credit card is similar to that of an unsecured card, but with the added requirement of a security deposit.

- Gather necessary documentation: This typically includes your EIN, business registration information, personal credit report, and financial statements demonstrating your business’s financial health. You will also need to provide information about the security deposit you are prepared to provide.

- Compare offers: Research different lenders and compare interest rates, fees, and credit limits. Consider the terms and conditions carefully before making a decision.

- Complete the application: Fill out the application accurately and completely. Incomplete or inaccurate information can lead to delays or rejection.

- Provide the security deposit: Once approved, you’ll need to provide the required security deposit, which is typically refunded upon closure of the account, provided you have met all the terms and conditions.

Choosing the Right Secured Business Credit Card

Securing a business credit card with limited history can be challenging, but choosing the right secured card can significantly improve your financial standing. Understanding the various features and fees associated with different cards is crucial for making an informed decision that benefits your business. This section will guide you through the process of selecting the optimal secured business credit card for your specific needs.

Secured business credit cards differ significantly in terms of their interest rates, annual fees, rewards programs, and credit limits. Carefully comparing these factors is essential to finding the best fit for your business’s financial profile and spending habits. Remember that while a lower interest rate is generally preferable, other factors like rewards and fees can significantly impact the overall cost and value of the card.

Secured Business Credit Card Features: A Comparison

Several key features distinguish secured business credit cards. A thorough comparison of these features is vital for making a sound decision. Consider the following aspects to ensure you’re choosing a card that aligns with your business’s financial goals.

- Interest Rates (APR): This is the annual percentage rate you’ll pay on outstanding balances. Lower APRs are always preferable, but secured cards often have higher rates than unsecured options. Look for cards with competitive APRs, even within the secured card market.

- Annual Fees: Many secured cards charge an annual fee, which can add up over time. Some cards waive the annual fee for the first year, so be sure to read the fine print. Compare annual fees across different cards to find the most cost-effective option.

- Rewards Programs: Some secured business credit cards offer rewards programs, such as cashback, points, or miles. These programs can provide significant value, but only if your spending habits align with the rewards structure. Consider whether the rewards offered are valuable to your business.

- Credit Limit: The credit limit represents the maximum amount you can borrow. Secured cards typically have lower credit limits, usually reflecting the amount of your security deposit. A higher credit limit can be beneficial, but it also increases your potential debt.

- Other Fees: Be aware of potential fees beyond annual fees, such as late payment fees, balance transfer fees, and foreign transaction fees. These fees can significantly impact the overall cost of the card.

Factors to Consider When Selecting a Secured Business Credit Card, Secure business credit cards for businesses with limited credit history

Making the right choice involves weighing several factors. Prioritizing these elements will help you select a card that supports your business’s financial health and growth.

- Your Credit Score and History: Your credit score and history will significantly influence the cards available to you and the terms offered. A lower score may limit your options, but a secured card is designed to help rebuild credit.

- Required Security Deposit: Secured cards require a security deposit, which typically equals your credit limit. Consider how much you can comfortably deposit without impacting your business’s operating capital.

- Spending Habits: Analyze your business’s spending patterns to determine if a rewards program would be beneficial. Choose a card whose rewards structure aligns with your spending habits.

- Long-Term Goals: Consider how using the secured card will contribute to building your business credit and achieving your long-term financial objectives. Using the card responsibly is key to improving your credit score.

- Customer Service and Accessibility: Evaluate the card issuer’s reputation for customer service and the ease of accessing account information and support.

Decision-Making Flowchart for Choosing a Secured Business Credit Card

A structured approach simplifies the selection process. This flowchart guides you through the key considerations.

Start: Do you need a secured business credit card? Yes: Proceed. No: Stop.

Next: Determine your required credit limit and security deposit amount. Then: Compare cards based on APR, annual fees, and rewards programs. Next: Evaluate customer service and accessibility. Finally: Choose the card that best fits your needs and budget.

Examples of Secured Business Credit Card Offers

Here are examples of hypothetical offers to illustrate the variety of features available. Remember that actual offers vary by issuer and applicant.

- Card A: $500 credit limit, $500 security deposit, 18% APR, $0 annual fee, 1% cashback on all purchases. This card offers a basic, no-frills option for building credit.

- Card B: $1000 credit limit, $1000 security deposit, 22% APR, $50 annual fee, 2% cashback on office supplies and 1% on other purchases. This card offers a higher credit limit and rewards for specific spending categories.

- Card C: $2000 credit limit, $2000 security deposit, 25% APR, $75 annual fee, no rewards program. This card offers a higher credit limit but with a higher APR and annual fee.

Managing and Improving Business Credit

Building and maintaining a strong business credit profile is crucial for accessing favorable financing options and establishing credibility with vendors and suppliers. Responsible credit card usage is a cornerstone of this process, directly impacting your business credit score and overall financial health. By diligently managing your business credit card, you lay the foundation for future growth and financial stability.Responsible credit card usage involves more than simply making payments; it’s about demonstrating consistent and reliable financial behavior.

This includes understanding your credit limit, consistently paying your balance on time, and keeping your credit utilization low. Each of these factors contributes to a positive credit history.

Responsible Credit Card Usage for Building Business Credit

Utilizing your business credit card responsibly directly impacts your creditworthiness. This involves understanding and adhering to your credit limit, consistently making on-time payments, and maintaining a low credit utilization ratio. For example, if your credit limit is $10,000, aim to keep your outstanding balance below $3,000 (30% utilization) to demonstrate responsible spending habits. Regularly reviewing your statements helps you track your spending and ensure you stay within your limits.

Consistent on-time payments showcase your reliability to lenders and significantly improve your credit score over time. Late payments can negatively impact your score and make it harder to secure future credit.

Best Practices for Paying Down Business Credit Card Debt

Effectively managing business credit card debt is key to maintaining a healthy credit profile. Developing a repayment strategy is crucial. This might involve prioritizing high-interest debt, allocating a specific portion of your monthly revenue towards debt repayment, or exploring debt consolidation options to lower interest rates and simplify payments. For instance, a business could allocate 10% of monthly profits to pay down its highest-interest credit card, systematically reducing its debt over time.

Creating a detailed budget and tracking your progress can also significantly improve your ability to pay down debt effectively. Consider exploring options such as balance transfers to lower interest rates, but be mindful of any associated fees.

Importance of Monitoring Business Credit Reports and Scores

Regularly monitoring your business credit reports and scores is essential for identifying and addressing any potential issues promptly. Several credit bureaus, such as Experian, Equifax, and Dun & Bradstreet, provide business credit reports. These reports contain crucial information about your business’s credit history, including payment history, outstanding debts, and public records. By reviewing these reports regularly, you can identify and rectify any inaccuracies or discrepancies, preventing them from negatively affecting your credit score.

A consistent monitoring process allows for proactive management of your credit health, preventing minor issues from escalating into major problems.

Disputing Inaccurate Information on a Business Credit Report

If you discover inaccurate information on your business credit report, taking steps to dispute it is crucial. Each credit bureau has a process for submitting disputes. This usually involves providing documentation to support your claim, such as invoices, payment confirmations, or other relevant evidence. It’s important to meticulously document all communication with the credit bureaus during the dispute process.

For example, if a late payment is incorrectly reported, providing proof of on-time payment is essential. Responding promptly and thoroughly increases the chances of a successful resolution, protecting your business credit score from the negative impact of inaccurate information.

Beyond Credit Cards

Building business credit takes time, and securing a business credit card might not always be feasible, especially for startups or businesses with limited history. Fortunately, several alternative funding options exist to help you finance your operations and growth. Understanding these alternatives is crucial for making informed financial decisions.

While business credit cards offer convenience and can help build credit, they are not the only source of funding available. Other options, such as small business loans and lines of credit, provide different levels of flexibility and come with their own sets of advantages and disadvantages. Carefully evaluating your needs and circumstances is key to selecting the most suitable financing solution.

Small Business Loans

Small business loans provide a lump sum of money that you repay over a predetermined period with interest. These loans can be used for various purposes, including purchasing equipment, expanding operations, or managing cash flow. The approval process typically involves a credit check, but some lenders specialize in working with businesses that have limited credit history.

The advantages of small business loans include the ability to obtain a significant amount of capital upfront and the fixed repayment schedule. However, securing a loan can be more challenging than getting a credit card, and the interest rates can be higher, especially for businesses with less-established credit. Furthermore, the loan application process itself can be lengthy and complex.

Lines of Credit

A line of credit functions similarly to a credit card, but instead of a fixed credit limit, you are given access to a revolving pool of funds. You can borrow and repay as needed, up to your approved credit limit. This flexibility makes lines of credit particularly useful for managing unpredictable expenses.

Lines of credit offer greater flexibility than loans because you only pay interest on the amount you borrow. However, the interest rates can be variable, potentially leading to higher costs if rates rise. Additionally, the approval process may still require a credit check and documentation of your business’s financial health.

Alternative Lenders Catering to Businesses with Limited Credit

Finding funding when your business credit is limited can be challenging, but several lenders specialize in providing financial support to startups and young businesses. These lenders often focus on factors beyond traditional credit scores, such as revenue, cash flow, and business plan.

It’s important to research and compare lenders carefully to find the best fit for your specific circumstances. Interest rates and terms can vary significantly, so obtaining multiple quotes is recommended.

- OnDeck: Known for its speed and focus on small businesses.

- Kabbage: Offers flexible financing options, often using alternative data to assess creditworthiness.

- Lendio: A marketplace that connects businesses with various lenders, increasing your chances of finding a suitable option.

- Funding Circle: Provides peer-to-peer lending, connecting businesses with individual investors.

Comparison of Funding Options

| Funding Option | Pros | Cons | Suitable For |

|---|---|---|---|

| Secured Business Credit Card | Builds credit, convenient access to funds | Requires a security deposit, lower credit limits | Businesses with limited credit history needing to build credit |

| Small Business Loan | Large lump sum, fixed repayment schedule | Higher interest rates, longer approval process | Businesses needing significant capital for expansion or equipment |

| Line of Credit | Flexible access to funds, only pay interest on what you borrow | Variable interest rates, potential for high costs | Businesses with fluctuating expenses needing short-term funding |

Building a Strong Business Credit Profile

Building a robust business credit profile is crucial for accessing favorable financing options and securing future business growth. A strong profile demonstrates financial responsibility and trustworthiness to lenders, leading to better interest rates and higher credit limits. This involves consistent effort and strategic planning, focusing on key aspects like payment history and credit utilization.Consistent on-time payments are the cornerstone of a healthy business credit score.

Lenders heavily weigh your payment history when assessing your creditworthiness. Missing payments, even by a few days, can significantly damage your score and make it harder to obtain credit in the future. Conversely, a consistent track record of on-time payments signals reliability and reduces risk for lenders, positively impacting your credit score.

The Impact of Consistent On-Time Payments on Credit Scores

On-time payments are the single most important factor influencing your business credit score. Credit bureaus like Experian, Equifax, and Dun & Bradstreet track your payment history meticulously. Each missed or late payment is recorded and negatively affects your score. Conversely, consistent on-time payments demonstrate financial responsibility and contribute to a higher credit score. For example, a business consistently paying its bills on time for two years might see its score increase by 50-100 points, depending on other factors.

This improved score can unlock access to better loan terms and lower interest rates.

Maintaining a Healthy Business Credit Utilization Ratio

Maintaining a low business credit utilization ratio is equally crucial. This ratio represents the amount of credit you’re using compared to your total available credit. A high utilization ratio suggests you’re heavily reliant on credit, signaling increased risk to lenders. Aim to keep your utilization ratio below 30%; ideally, strive for below 10%. For instance, if you have a total credit limit of $10,000 across your business credit cards and loans, keeping your outstanding balance below $3,000 (30%) is recommended.

Lowering this ratio demonstrates responsible credit management and improves your credit score.

Improving Business Credit Scores Over Time

Improving your business credit score is a gradual process requiring consistent effort. Regularly monitoring your credit reports from all three major bureaus is essential. Dispute any inaccuracies promptly. Pay down existing debt aggressively to lower your utilization ratio. Applying for new credit sparingly is also important, as too many inquiries can negatively impact your score.

Consider using a business credit monitoring service to track your progress and identify areas for improvement. By consistently applying these strategies, you can observe a gradual yet substantial increase in your business credit score over time. For example, a business diligently paying down debt and maintaining a low utilization ratio for six months might see a 20-40 point increase.

Strategies for Diversifying Business Credit Accounts

Diversifying your business credit accounts can strengthen your credit profile. Don’t rely solely on credit cards; explore other credit options such as business loans, lines of credit, and vendor financing. This demonstrates a broader and more responsible approach to credit management. Each positive credit account adds to your overall credit history, making your profile more attractive to lenders.

For example, securing a small business loan in addition to managing a credit card responsibly would improve the diversity of your credit profile and potentially increase your score. The key is responsible use across all credit accounts.

Establishing and maintaining strong business credit is an ongoing process requiring careful planning and diligent management. While securing a business credit card is a significant step, remember that responsible credit usage, consistent on-time payments, and proactive credit monitoring are crucial for long-term financial health. By understanding the available options and employing the strategies Artikeld, businesses with limited credit history can build a solid financial foundation for sustained growth and success.

Explore all available avenues and choose the path that best suits your business’s unique needs and goals.

FAQs

What is a secured business credit card?

A secured business credit card requires a cash security deposit that acts as collateral, reducing the lender’s risk. This makes it easier to qualify even with limited credit history.

How much of a security deposit is typically required?

The required security deposit varies depending on the lender and the credit limit offered. It can range from a few hundred to several thousand dollars.

Can I get a secured business credit card with a low credit score?

Yes, secured business credit cards are often more accessible to businesses with low credit scores than unsecured cards. The security deposit mitigates the lender’s risk.

Will a secured business credit card affect my personal credit score?

Generally, secured business credit cards do not directly impact your personal credit score. However, consistently poor management of the business credit card could indirectly affect your personal credit in the long run.

What happens to my security deposit after I close the account?

Once you close the account in good standing, the lender typically returns your security deposit, minus any outstanding fees or balances.