0% APR Credit Cards Long-Term Options?

Are there any credit cards that offer 0% APR for a long period? This question frequently arises among consumers seeking financial flexibility. Securing a credit card with an extended 0% APR introductory period can be a powerful tool for managing debt, consolidating balances, or financing large purchases. However, understanding the terms, conditions, and potential pitfalls is crucial before committing to such a card.

This exploration delves into the intricacies of extended 0% APR credit cards, helping you make informed decisions.

We’ll examine various credit card offers, comparing interest-free periods, annual fees, and required credit scores. We’ll also discuss the importance of responsible usage to avoid high interest charges after the promotional period ends, and consider alternative card benefits to determine which option best suits your financial needs.

Comparing 0% APR Offers with Other Credit Card Benefits: Are There Any Credit Cards That Offer 0% APR For A Long Period

Choosing between a credit card offering a 0% APR introductory period and one with attractive rewards can be a significant financial decision. The best choice depends entirely on your immediate needs and spending habits. While both offer distinct advantages, understanding their differences is crucial for making an informed decision.Understanding the trade-offs between 0% APR and rewards cards is key to optimizing your finances.

A 0% APR card provides a grace period to pay off existing debt without accruing interest, while rewards cards offer cashback, points, or miles on purchases, potentially offsetting spending. The optimal choice hinges on whether you prioritize debt reduction or maximizing rewards.

0% APR Cards versus Rewards Cards: Advantages and Disadvantages

% APR cards offer a significant advantage for consumers with existing high-interest debt. By transferring balances or making large purchases, individuals can significantly reduce their interest payments during the promotional period. However, the disadvantage lies in the often-high interest rates that kick in after the promotional period expires. Furthermore, these cards typically offer minimal or no rewards programs.

Conversely, rewards cards provide ongoing benefits like cashback, points, or miles, which can add up over time. However, carrying a balance on a rewards card can quickly negate the value of the rewards due to accumulated interest charges. A key consideration is the APR on a rewards card, which could be substantially higher than the eventual rate on a 0% APR card after the promotional period ends.

Scenarios Favoring 0% APR Cards

A 0% APR card is particularly beneficial when facing a large, high-interest debt, such as an existing credit card balance or a significant purchase. For example, imagine someone with $5,000 in credit card debt at a 20% APR. Transferring this debt to a card offering 18 months of 0% APR would save them considerable interest during that period, allowing them to focus on paying down the principal.

This strategic use can significantly reduce the total cost of the debt. Another scenario involves home renovations or large medical expenses. Using a 0% APR card for these one-time, high-cost purchases allows for manageable monthly payments without accruing immediate interest charges, providing a breathing room for repayment.

Choosing the Right Credit Card Based on Individual Needs

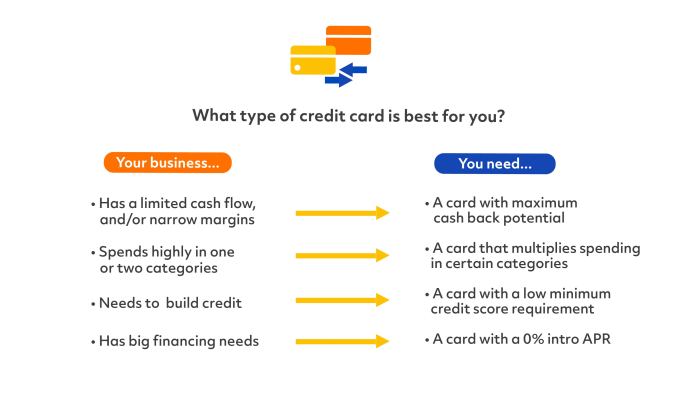

The optimal credit card choice depends heavily on individual financial priorities. If debt reduction is paramount, a 0% APR card is generally preferable, especially for high-interest debt. However, careful attention must be paid to the post-promotional APR and the repayment plan to avoid a future debt burden. For individuals with lower levels of debt and a consistent spending pattern, a rewards card offering cashback or other rewards might be more advantageous, provided they can manage their spending and pay their balance in full each month.

A budget and a clear understanding of spending habits are crucial in making this decision. Factors like annual fees, foreign transaction fees, and the specific rewards program offered should also be carefully considered before making a final choice.

Responsible Use of 0% APR Credit Cards

Securing a 0% APR credit card can be a powerful tool for managing debt or financing large purchases, but responsible use is crucial to avoid potential pitfalls. Failing to understand and adhere to the terms can quickly negate the benefits and lead to significant financial hardship. This section Artikels a practical approach to utilizing 0% APR cards effectively and safely.

Steps for Responsible 0% APR Credit Card Use, Are there any credit cards that offer 0% APR for a long period

A structured approach is key to maximizing the benefits of a 0% APR period. Following these steps will help you navigate this financial tool responsibly.

- Understand the Terms and Conditions: Carefully review the credit card agreement. Pay close attention to the introductory period length, the APR after the promotional period ends, any fees (annual fees, balance transfer fees, etc.), and the minimum payment requirements. Understanding these details is the foundation of responsible use.

- Create a Repayment Plan: Develop a detailed budget that allocates sufficient funds to repay the balance in full before the 0% APR period ends. Consider using online budgeting tools or spreadsheets to track your progress. Break down the total balance into manageable monthly payments.

- Prioritize High-Interest Debt: If you’re using the 0% APR card to consolidate existing debt, prioritize paying off high-interest debts first. This strategy maximizes your savings by minimizing the overall interest paid.

- Automate Payments: Set up automatic payments to ensure you consistently meet your minimum payment deadlines and avoid late fees. This proactive approach reduces the risk of missed payments and negative impacts on your credit score.

- Monitor Your Spending: Track your spending closely to avoid exceeding your credit limit. Overspending can lead to high interest charges once the 0% APR period expires.

Budgeting and Debt Management Tips

Effective budgeting and debt management are crucial for successful 0% APR credit card utilization. These tips will help you stay on track.

Create a realistic budget that accounts for all income and expenses. Identify areas where you can reduce spending to free up more funds for debt repayment. Prioritize essential expenses and consider cutting back on non-essential spending during the 0% APR period. Regularly review and adjust your budget as needed to stay on track.

Consequences of Mismanaging 0% APR Debt

Failing to repay the balance before the 0% APR period expires can have severe financial repercussions.

Once the promotional period ends, the standard APR, often significantly higher, will apply to the remaining balance. This can lead to a rapid accumulation of interest charges, making it much harder to repay the debt. Late payments can further damage your credit score, making it more difficult to obtain loans or credit in the future. In severe cases, it could lead to debt collection actions.

Visual Representation of Risks

Imagine a graph. The x-axis represents time, showing the 0% APR period. The y-axis represents the outstanding balance. Initially, the line slopes downward, representing successful debt reduction. However, if payments are missed or insufficient, the line levels off or even curves upward sharply once the 0% period ends, dramatically increasing the outstanding balance due to the high interest rate.

This visual illustrates the potential for a small initial slip to snowball into a large debt burden.

Navigating the world of 0% APR credit cards requires careful consideration of the terms and conditions. While the allure of an extended interest-free period is undeniable, responsible financial planning is paramount. By understanding the associated fees, interest rate changes after the promotional period, and the importance of timely repayment, consumers can leverage these cards effectively. Remember to compare various offers, assessing your creditworthiness and financial goals to select the card that aligns best with your individual circumstances.

Frequently Asked Questions

What happens if I don’t pay off my balance before the 0% APR period ends?

The standard APR (Annual Percentage Rate) for the card will apply to your remaining balance, potentially resulting in significant interest charges.

Can I transfer balances from other credit cards to a 0% APR card?

Many 0% APR cards allow balance transfers, but often with fees. Check the terms and conditions carefully.

How is my credit score affected by applying for a 0% APR credit card?

Applying for any credit card results in a hard inquiry on your credit report, which can slightly lower your score temporarily. Approval depends on your credit history and the card issuer’s criteria.

Are there any penalties for paying off a 0% APR balance early?

Generally, there are no penalties for early payoff, though some cards may have stipulations.