Business Credit Cards Purchase Protection & Extended Warranty

Business credit cards that offer purchase protection and extended warranty provide invaluable benefits for businesses of all sizes. These cards go beyond simple payment processing, offering crucial safeguards against unexpected costs and extending the lifespan of valuable equipment or supplies. This comprehensive guide explores the key features, benefits, and considerations involved in choosing the right card to protect your business investments.

Understanding the nuances of purchase protection and extended warranties offered by different business credit cards is vital for maximizing their value. Factors such as coverage limits, eligibility criteria, and the claims process all play a significant role in determining the overall utility of these features. By carefully comparing various cards and understanding their terms and conditions, businesses can make informed decisions that best suit their needs and budget.

Introduction to Business Credit Cards with Purchase Protection and Extended Warranty

Business credit cards are financial tools designed specifically for businesses, offering a convenient way to manage expenses and build business credit. Unlike personal credit cards, they often come with higher credit limits and features tailored to the needs of companies of all sizes. This includes valuable add-ons such as purchase protection and extended warranties, which can significantly reduce financial risks and enhance the overall value proposition.Purchase protection and extended warranties are valuable features that can safeguard your business investments and minimize unexpected costs.

Purchase protection typically covers items purchased with your business credit card against damage, theft, or loss within a specified timeframe. Extended warranties extend the manufacturer’s warranty on eligible purchases, providing additional coverage and peace of mind. These features can be invaluable for businesses dealing with equipment, supplies, or other assets that may be susceptible to damage or failure.

Benefits of Purchase Protection and Extended Warranty for Businesses

These features offer several tangible advantages for businesses. Purchase protection can significantly reduce the financial burden associated with unexpected damage or loss of valuable business assets. Imagine a laptop purchased with a business credit card being stolen; with purchase protection, the card issuer might cover the replacement cost, minimizing the disruption to your operations. Similarly, an extended warranty can save a business substantial repair or replacement costs if a piece of equipment malfunctions after the manufacturer’s warranty expires.

For example, a commercial espresso machine breaking down after the initial warranty period could lead to significant repair costs; an extended warranty would alleviate this financial pressure. These cost savings contribute to improved cash flow and reduced operational expenses.

Examples of Purchase Protection and Extended Warranty in Action

Consider a small bakery purchasing a new commercial oven with their business credit card. If the oven is damaged during delivery, the purchase protection feature could cover the cost of repairs or replacement. Or, if a construction company buys power tools and extends the warranty through their credit card, they’re protected against costly repairs should a tool fail prematurely.

These scenarios demonstrate how these features can protect against significant unexpected expenses, contributing to a more stable and predictable financial outlook for the business. The value of these protections can easily outweigh the annual fee of the business credit card, especially for businesses that frequently make significant purchases.

Key Features to Compare Across Different Cards: Business Credit Cards That Offer Purchase Protection And Extended Warranty

Choosing the right business credit card with purchase protection and extended warranty requires careful consideration of several key features. These benefits, while seemingly similar across cards, often vary significantly in their scope and limitations. Understanding these differences is crucial for maximizing the value you receive.

Purchase Protection Coverage Comparison

Purchase protection insurance typically covers items purchased with your business credit card against damage, theft, or loss within a specific timeframe. However, coverage limits, exclusions (such as pre-existing conditions or damage due to negligence), and claim processes differ widely. Some cards may offer a higher coverage limit, while others may have stricter requirements for filing a claim. For example, one card might cover up to $10,000 per claim with a 90-day return window, while another may only offer $5,000 with a 60-day window.

Always review the terms and conditions carefully to understand the specific details of your card’s purchase protection.

Extended Warranty Duration Differences

Extended warranties, another attractive feature, add extra time to the manufacturer’s warranty on eligible purchases. The duration of this extended coverage varies significantly between credit card issuers. Some cards might offer an additional year, while others could extend the warranty by up to two years. Additionally, the types of purchases covered under the extended warranty may differ. Some cards might exclude certain product categories, such as electronics with short manufacturer warranties.

Understanding these differences is key to choosing a card that best aligns with your typical business purchases.

Other Significant Benefits

Beyond purchase protection and extended warranties, many business credit cards offer additional valuable benefits. Robust rewards programs are a common feature, allowing you to earn points, miles, or cash back on your business spending. These rewards can be redeemed for travel, merchandise, or statement credits, providing substantial savings over time. Furthermore, some cards include travel insurance, offering coverage for trip cancellations, lost luggage, or medical emergencies while traveling on business.

The inclusion and specifics of travel insurance, such as coverage limits and eligibility criteria, will vary depending on the issuer and card.

Business Credit Card Comparison Table

| Card Name | Purchase Protection Details | Extended Warranty Details | Annual Fee |

|---|---|---|---|

| Example Card A | $10,000 per claim, 90-day return window, some exclusions apply | 1 additional year on manufacturer’s warranty | $95 |

| Example Card B | $5,000 per claim, 60-day return window, excludes certain electronics | Up to 2 additional years on manufacturer’s warranty | $0 |

| Example Card C | $7,500 per claim, 120-day return window, standard exclusions | 1 additional year on manufacturer’s warranty, some exclusions apply | $150 |

| Example Card D | $2,500 per claim, 30-day return window, limited exclusions | No extended warranty | $0 |

Eligibility and Application Process

Securing a business credit card with valuable perks like purchase protection and extended warranties hinges on meeting specific eligibility criteria and navigating the application process effectively. Understanding these aspects is crucial for a smooth and successful application.The eligibility requirements for a business credit card are similar to those for personal credit cards, but with a focus on the business itself.

Lenders assess various factors to determine your creditworthiness and the financial health of your business.

Eligibility Requirements

Lenders typically evaluate several key factors to assess your eligibility. These include your personal credit score, business credit history (if applicable), annual revenue, time in business, and the type of business entity. A strong personal credit score is often a significant factor, even for business cards, demonstrating responsible financial management. A well-established business with a demonstrable history of profitability significantly increases your chances of approval.

The type of business also plays a role; some industries may be considered higher risk than others. For example, a well-established law firm is likely to be viewed more favorably than a newly launched startup in a highly competitive market.

Application Process

The application process generally involves completing an online application form, providing necessary documentation, and undergoing a credit check. The application form will request information about your business, including its legal structure (sole proprietorship, LLC, corporation, etc.), annual revenue, and the number of employees. Required documentation may include your driver’s license or other government-issued identification, articles of incorporation or business license, tax returns (e.g., IRS Form 1040 Schedule C or equivalent), and bank statements.

Providing complete and accurate information is crucial for a timely approval.

Factors Affecting Approval

Several factors influence the approval or denial of your application. A high personal credit score and a strong business credit history significantly increase your chances. Consistent and substantial revenue demonstrates financial stability and reduces lender risk. The length of time your business has been operating also plays a role; longer-established businesses tend to be viewed more favorably.

Finally, the type of business and its perceived risk are considered; some industries may face stricter lending criteria than others. For example, a business with a history of late payments or bankruptcies will likely face difficulties securing a business credit card, regardless of its current financial situation. Similarly, a new business with limited financial history may require a personal guarantee from the owner.

Managing and Utilizing Card Benefits

Successfully leveraging the purchase protection and extended warranty benefits offered by your business credit card requires understanding the claim process and employing strategic practices to maximize their value. These benefits can significantly reduce financial risks associated with business purchases and extend the lifespan of your equipment, ultimately saving you money.

Understanding how to file a claim and strategically utilizing these benefits is crucial for maximizing their value. The process is generally straightforward, but familiarity with the specific terms and conditions of your card’s agreement is essential. By understanding when and how to utilize these benefits, businesses can mitigate unexpected expenses and extend the useful life of their assets.

Filing a Claim for Purchase Protection or Extended Warranty

To file a claim, you’ll typically need to contact the card issuer’s customer service department. They will guide you through the process and provide the necessary claim forms. Be prepared to provide documentation such as proof of purchase (receipts, invoices), details of the damage or malfunction, and any relevant repair or replacement quotes. The specific documentation required will vary depending on the nature of the claim and the card issuer’s policy.

Most issuers require claims to be filed within a specific timeframe after the incident, so act promptly. Keep all relevant documentation in a safe place, organized by date and purchase. Accurate record-keeping significantly simplifies the claim process and improves your chances of a successful outcome. For example, if a piece of expensive equipment malfunctions within the extended warranty period, having all the original purchase documentation readily available will streamline the claim process and minimize any delays.

Best Practices for Maximizing the Value of Card Benefits

Effective utilization of purchase protection and extended warranties requires proactive planning and attention to detail. Regularly review your card’s terms and conditions to understand the coverage limits, exclusions, and claim procedures. Maintain meticulous records of all purchases made with the card, including receipts, invoices, and warranties. This organized approach ensures you have the necessary documentation readily available should you need to file a claim.

Consider purchasing higher-value items with the card to maximize the potential return on these benefits. For example, if your card offers purchase protection up to $10,000, consider using it for significant business investments. Proactive maintenance of purchased items can also help prevent issues that might trigger a claim, though this won’t replace the benefit of having the coverage in place for unforeseen circumstances.

Examples of Situations Where These Benefits Are Most Useful

These benefits prove invaluable in various business scenarios. Imagine purchasing a new laptop for your business and accidentally damaging it within the purchase protection period. The card’s purchase protection would cover the repair or replacement costs, saving you significant expense. Or consider a scenario where a vital piece of machinery breaks down after the manufacturer’s warranty expires but falls within the extended warranty period offered by your credit card.

The extended warranty would cover the repair or replacement, preventing costly downtime and repairs. Similarly, if you purchase expensive software and it proves defective, purchase protection may cover the cost of a replacement or refund. In all these instances, the card’s benefits protect your business from unexpected financial burdens and operational disruptions.

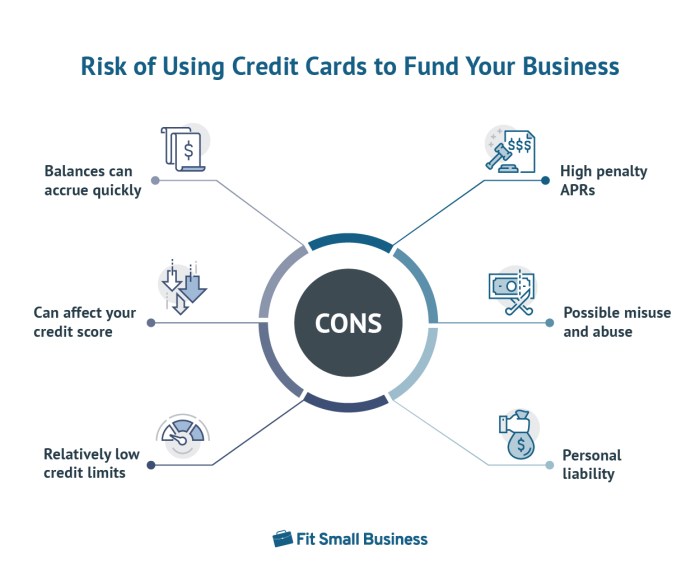

Potential Drawbacks and Considerations

While business credit cards offering purchase protection and extended warranties present significant advantages, it’s crucial to understand their limitations to make informed decisions. Overlooking potential drawbacks could negate the benefits and even lead to unexpected financial burdens. A thorough understanding of the terms and conditions, along with a realistic assessment of fees and interest rates, is paramount.Understanding the fine print is essential to maximizing the value of these benefits.

Many cardholders mistakenly assume blanket coverage, leading to disappointment when a claim is denied. The specific terms and conditions governing purchase protection and extended warranties vary significantly across different card issuers and even between different cards offered by the same issuer. These variations can impact the types of purchases covered, the claim process, and the extent of reimbursement.

Limitations of Purchase Protection and Extended Warranties, Business credit cards that offer purchase protection and extended warranty

Purchase protection and extended warranties, while valuable, often come with limitations. For example, coverage may exclude certain product categories, such as consumables or perishable goods. There might be limits on the total amount of coverage per claim or per year. Pre-existing conditions or damage caused by misuse or negligence are typically not covered. The claim process itself can be complex, requiring detailed documentation and potentially lengthy processing times.

For instance, a cardholder might need to provide original receipts, photographs of the damaged goods, and a detailed explanation of the incident. Failure to meet these requirements can result in a denied claim.

Impact of Annual Fees and Interest Rates

Annual fees and interest rates significantly impact the overall value proposition of a business credit card. High annual fees can quickly outweigh the benefits of purchase protection and extended warranties, especially if these benefits are rarely utilized. Similarly, carrying a balance on the card will incur interest charges, potentially negating any savings from extended warranties or purchase protection.

For example, a card with a $100 annual fee and a high interest rate might only be worthwhile if the cardholder makes significant purchases that frequently utilize the added benefits, and diligently pays off the balance in full each month. Failing to do so will quickly erode any financial advantage.

Importance of Thoroughly Reviewing Terms and Conditions

Before applying for a business credit card with purchase protection and extended warranties, it’s imperative to carefully review the terms and conditions. This document Artikels the specific coverage, limitations, and claim procedures. Paying close attention to details like eligibility criteria, exclusions, and claim deadlines is crucial to avoid disappointment later. Ignoring this step can lead to a false sense of security and ultimately result in denied claims or unexpected expenses.

Understanding the nuances of the policy ensures that the cardholder can utilize the benefits effectively and avoid any surprises.

Ultimately, selecting a business credit card with purchase protection and extended warranty involves a careful assessment of your business’s specific needs and risk profile. While the added protection and potential cost savings are significant advantages, it’s crucial to weigh these benefits against the associated annual fees and interest rates. By thoroughly understanding the terms and conditions of each card and comparing offerings from various issuers, you can confidently choose a card that provides optimal value and strengthens your financial security.

Questions and Answers

What constitutes “damage” under purchase protection?

Definitions vary by card issuer, but generally include accidental damage, theft, or loss within a specified timeframe after purchase. Review your card’s terms and conditions for precise details.

How long does the extended warranty typically last?

Extended warranties usually add a year or more to the manufacturer’s warranty, but the duration varies depending on the card and the item purchased. Check the specific terms for each card.

Can I use purchase protection for items bought online?

Most cards cover online purchases, but verify this in the cardholder agreement. Some might have restrictions on specific types of online vendors.

What happens if my claim is denied?

Card issuers will provide a reason for denial. You can typically appeal the decision by providing additional supporting documentation.