What Are the Best Business Credit Cards for E-commerce Businesses?

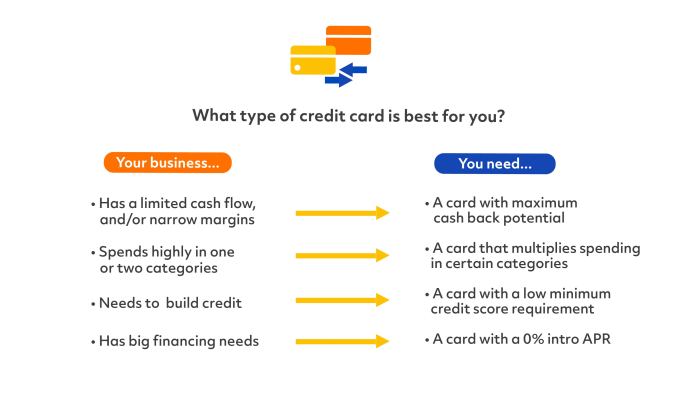

What are the best business credit cards for e-commerce businesses? This crucial question faces every online entrepreneur striving for financial success. Navigating the complex world of business credit cards requires careful consideration of rewards programs, interest rates, credit limits, and security features. Understanding these elements is paramount to leveraging the power of credit for growth and profitability, ultimately shaping the financial health of your e-commerce venture.

This guide delves into the specifics, empowering you to make informed decisions.

Choosing the right business credit card can significantly impact your e-commerce business. Factors like rewards structures tailored to online spending (advertising, shipping, supplies), manageable interest rates, and sufficient credit limits are key. Furthermore, robust fraud protection is vital given the inherent risks of online transactions. This analysis will equip you to compare various cards, assess their suitability for your business model, and ultimately select the option that best aligns with your financial goals.

Best Rewards Programs for E-commerce

Choosing the right business credit card can significantly impact your e-commerce profitability. A robust rewards program can offset operational costs, offering substantial long-term benefits. This section analyzes several leading business credit cards, comparing their rewards structures and highlighting how e-commerce businesses can optimize their earning potential.

Rewards Program Comparison for E-commerce Businesses

The following table compares the rewards programs of five major business credit cards, focusing on categories relevant to e-commerce operations. Note that rewards rates and bonus categories can change, so always verify current terms and conditions on the card issuer’s website.

| Card Name | Rewards Rate (per dollar spent) | Bonus Categories | Redemption Options |

|---|---|---|---|

| American Express® Business Platinum Card® | 1.5x Membership Rewards points on most purchases; potentially higher with select Amex Offers; bonus categories vary | Often includes bonus categories for select business expenses, but specifics change frequently. Check Amex’s website for the most up-to-date information. | Statement credits, travel, merchandise, gift cards |

| Chase Ink Business Preferred® Credit Card | 5x Ultimate Rewards® points on the first $250,000 spent in combined purchases each account anniversary year on purchases of internet, cable, and phone services; 2x on the next $250,000 spent in combined purchases each account anniversary year on purchases at restaurants, at select U.S. wireless providers, and on purchases of travel; 1x on all other purchases. | Internet, cable, and phone services; travel; restaurants; select U.S. wireless providers. | Travel, cash back, merchandise |

| Capital One Spark Miles for Business | 2x miles on every purchase | No specific bonus categories. | Travel, cash back |

| U.S. Bank Business Leverage Card | 1.5x points on purchases; higher rewards possible with various promotions. | Specific bonus categories vary based on promotions; check the U.S. Bank website for current offers. | Cash back, travel, merchandise |

| Ink Business Cash Credit Card | 5% cash back on the first $25,000 spent each account anniversary year on purchases from office supply stores and on internet, cable, and phone services; 2% on the next $25,000 spent each account anniversary year on all other purchases from restaurants and at gas stations; 1% on all other purchases. | Office supply stores; internet, cable, and phone services; restaurants; gas stations. | Cash back |

Value Proposition of Each Rewards Program

Each rewards program offers a unique value proposition. The American Express Business Platinum Card’s Membership Rewards program provides flexibility, allowing redemption for various options. The Chase Ink Business Preferred Card’s Ultimate Rewards program excels for businesses with significant spending on internet services or travel. The Capital One Spark Miles card offers simplicity with consistent earning, while the U.S.

Bank Business Leverage Card and Chase Ink Business Cash Card provide opportunities for bonus rewards through targeted spending. The long-term benefit lies in the potential for substantial cost savings by accumulating rewards points over time.

Maximizing Rewards Points for E-commerce Businesses

E-commerce businesses can maximize rewards by strategically aligning their spending with bonus categories. For instance, a business with high advertising spend might prioritize a card with bonus rewards on advertising platforms. Similarly, a business with significant shipping costs could benefit from a card offering bonus rewards on shipping expenses, if available. Careful planning and tracking of spending can lead to significant reward point accumulation, offsetting operational expenses and boosting profitability.

For example, an online retailer spending $10,000 annually on advertising with a card offering 5x points on advertising could earn 50,000 points, potentially translating into significant statement credits or travel benefits. Another example: a business spending $5,000 monthly on shipping could earn a substantial number of points with a card offering bonus rewards in this category.

Interest Rates and Fees

Understanding the financial implications of business credit cards is crucial for the success of any e-commerce venture. High interest rates and hefty fees can quickly erode profits, especially during a business’s growth phase. This section will delve into the typical costs associated with business credit cards designed for e-commerce and offer strategies for effective financial management.Interest rates and annual fees are two key factors to consider when choosing a business credit card.

These costs can significantly impact your bottom line if not carefully managed. A clear understanding of these charges is essential for making informed decisions and maintaining healthy finances.

Typical Interest Rates and Annual Fees

The following table compares the interest rates and annual fees of five popular business credit cards often used by e-commerce businesses. Note that these rates and fees are subject to change, and it’s crucial to check the current offerings directly with the issuing bank or credit union. The examples below are for illustrative purposes only and do not represent a comprehensive list of all available cards.

| Credit Card | Annual Fee | APR (Purchase) | APR (Balance Transfer) |

|---|---|---|---|

| Example Card A | $0 | 18.24% – 25.24% Variable | 22.24% – 29.24% Variable |

| Example Card B | $95 | 19.99% – 26.99% Variable | 24.99% – 31.99% Variable |

| Example Card C | $0 | 21.49% – 28.49% Variable | 25.49% – 32.49% Variable |

| Example Card D | $150 | 17.49% – 24.49% Variable | 21.49% – 28.49% Variable |

| Example Card E | $0 | 20.24% – 27.24% Variable | 24.24% – 31.24% Variable |

Impact of High Interest Rates and Fees on E-commerce Businesses

High interest rates and fees can severely impact the financial health of a growing e-commerce business. Carrying a balance on a high-interest credit card can quickly deplete profits, hindering reinvestment in marketing, inventory, or other crucial business functions. For instance, a small business with a $10,000 balance on a card with a 25% APR could pay over $2,500 in interest annually.

This significant expense directly reduces the business’s potential for growth and profitability. Additionally, excessive annual fees add further strain on already limited resources.

Strategies for Managing Interest Payments and Avoiding Unnecessary Fees

Effective management of business credit card expenses requires proactive strategies. Prioritizing prompt and full payment of balances each month is crucial to avoid accruing interest charges. This prevents the snowball effect of compounding interest, which can rapidly increase debt. Furthermore, carefully reviewing the terms and conditions of each card to understand all associated fees, including late payment fees, foreign transaction fees, and cash advance fees, is essential for avoiding unexpected costs.

Negotiating lower interest rates with the credit card company or exploring balance transfer options with lower APRs can also provide significant savings. Finally, consistently monitoring credit card statements for any discrepancies or unauthorized charges is vital for maintaining financial control and preventing fraud.

Credit Limits and Spending Power

Securing the right credit limit on your business credit card is crucial for the smooth operation of your e-commerce business. A well-chosen limit provides the financial flexibility needed to manage expenses and capitalize on opportunities, while an insufficient limit can severely restrict growth and even lead to financial hardship. Understanding the factors influencing credit limit approvals and the impact of different credit limits is essential for making informed decisions.Adequate credit limits are especially vital for e-commerce businesses due to the inherent volatility of online sales.

Seasonal fluctuations, marketing campaigns, and unexpected surges in demand can dramatically impact spending needs. A low credit limit can leave a business struggling to meet these demands, potentially hindering sales and damaging its reputation. Conversely, a sufficiently high limit provides a safety net, enabling the business to seize opportunities and weather unexpected downturns without compromising its operations. This financial flexibility allows for the purchase of inventory to meet increased demand, the funding of marketing initiatives to drive sales, and the management of unexpected expenses.

Factors Influencing Credit Limit Approvals

Several factors contribute to the credit limit a lender will offer on a business credit card. These factors are assessed to determine the applicant’s creditworthiness and ability to repay the debt. Key factors include the business’s credit history (including personal credit history of the owner(s)), length of time in business, annual revenue, existing debt levels, and the type of business.

A strong credit history, demonstrated financial stability, and a low debt-to-income ratio will generally result in higher credit limit approvals. Conversely, a shorter business history, high debt levels, or a poor credit score may result in lower limits or even rejection of the application. The specific requirements and weighting of these factors will vary between lenders.

Hypothetical Scenario: High vs. Low Credit Limit

Imagine “EcoChic,” a rapidly growing online retailer of sustainable fashion. In its first year, EcoChic secured a business credit card with a $5,000 credit limit. This limit seemed sufficient initially. However, unexpectedly, a viral social media campaign resulted in a massive surge in orders during the holiday season. EcoChic needed to purchase significantly more inventory to meet this demand.

With its low credit limit, EcoChic was forced to turn away orders, losing potential revenue and damaging its brand reputation. It also faced delays in fulfilling existing orders, leading to customer dissatisfaction and negative reviews.Now, consider an alternate scenario. If EcoChic had secured a business credit card with a $25,000 credit limit, it could have easily met the increased demand.

The higher limit allowed for the purchase of sufficient inventory, timely order fulfillment, and a positive customer experience. This enabled EcoChic to capitalize on the unexpected growth, strengthening its brand and establishing a stronger financial foundation for future expansion. This scenario clearly illustrates the significant advantage of a higher credit limit in handling unexpected growth and maximizing opportunities. The additional spending power afforded by a higher credit limit can be the difference between capitalizing on a growth spurt and losing potential revenue and damaging the business’s reputation.

Fraud Protection and Security Features

Choosing a business credit card for your e-commerce venture requires careful consideration of the security measures in place to protect your business from online fraud. The potential financial losses associated with fraudulent transactions can significantly impact a small business, making robust fraud protection a critical factor in your decision-making process. This section will delve into the specific security features offered by various business credit cards and emphasize the importance of strong security protocols for online businesses.Protecting your e-commerce business from fraud hinges on several key features and proactive measures.

Understanding these aspects can significantly reduce your risk exposure. A multi-layered approach, combining card issuer safeguards with your own diligent practices, forms the most effective defense.

Zero Liability Protection and Other Security Measures, What are the best business credit cards for e-commerce businesses

Zero liability protection is a crucial feature offered by many major credit card issuers. This means you are not held responsible for unauthorized charges made on your business credit card, provided you report the fraudulent activity promptly. However, the specifics of zero liability protection can vary between issuers, so it’s vital to review the terms and conditions carefully.

Beyond zero liability, additional security measures such as real-time fraud monitoring, transaction alerts, and the ability to temporarily freeze or block your card upon suspicion of fraudulent activity significantly enhance protection. Some cards also offer sophisticated technologies like EMV chip technology and advanced authentication methods (like 3D Secure) that add extra layers of security against unauthorized use. For instance, a card might offer an app that allows you to instantly disable your card if it’s lost or stolen, preventing further fraudulent transactions.

Comparison of Fraud Protection Features Across Business Credit Cards

Understanding the differences in fraud protection features across various business credit cards is essential for making an informed choice. The following bullet points highlight key variations:

- Real-time fraud alerts: Many cards offer real-time alerts via text message or email, notifying you of potentially fraudulent transactions as they occur, allowing for quick intervention.

- Transaction monitoring and review tools: Some cards provide online portals or mobile apps where you can easily review all transactions and flag suspicious activity for investigation.

- Fraudulent charge reversal assistance: While zero liability is standard, the level of support provided in disputing and reversing fraudulent charges can vary between issuers. Some offer more streamlined and efficient processes than others.

- International transaction fraud protection: For e-commerce businesses engaging in international transactions, specific protection against cross-border fraud is crucial. Some cards offer enhanced security features for international transactions.

- Employee card controls: For businesses using multiple employee cards, robust controls are essential. This might include setting spending limits, restricting transaction types, or the ability to instantly deactivate individual cards.

Best Practices for Securing Online Payments

Implementing strong security practices is crucial in mitigating the risk of online fraud, even with robust card protection. The following practices are essential:

- Use strong passwords and multi-factor authentication: Employ strong, unique passwords for all online accounts, including your business credit card account and e-commerce platform. Enable multi-factor authentication wherever possible.

- Keep software updated: Regularly update your operating systems, web browsers, and e-commerce platform software to patch security vulnerabilities.

- Secure your network: Use strong passwords and firewalls to protect your business network from unauthorized access.

- Regularly monitor transactions: Regularly review your business credit card statements for any unauthorized charges. Set up transaction alerts to receive immediate notifications of all transactions.

- Train employees: Educate your employees about online fraud prevention best practices and company policies regarding the use of business credit cards.

- Use secure payment gateways: Utilize reputable and secure payment gateways that employ encryption and other security protocols to protect sensitive customer data.

Benefits Beyond Rewards: What Are The Best Business Credit Cards For E-commerce Businesses

While lucrative rewards programs are a significant draw for e-commerce businesses choosing a business credit card, many cards offer additional perks that can significantly impact profitability and operational efficiency. These benefits often go unnoticed but can provide substantial value beyond the points or cashback earned. Understanding these additional features is crucial for selecting the card that best suits your business needs.Many business credit cards offer a range of supplementary benefits designed to protect your business and streamline operations.

These extend beyond the typical rewards programs and can offer significant cost savings or operational improvements. Understanding these benefits is critical to maximizing the value of your business credit card.

Purchase Protection and Extended Warranties

Purchase protection and extended warranties are valuable benefits frequently included with business credit cards. Purchase protection typically covers items purchased with the card against damage or theft for a specified period, often 90-120 days. Extended warranties extend the manufacturer’s warranty on eligible purchases, providing added protection against unforeseen repairs or replacements. These benefits can significantly reduce the risk associated with inventory or equipment purchases, protecting your business investment.

For example, if a high-value piece of equipment purchased for your e-commerce fulfillment center is damaged shortly after purchase, the purchase protection offered by your business credit card could cover the repair or replacement costs, avoiding a potentially substantial financial setback.

Travel and Accident Insurance

Some business credit cards offer travel insurance benefits, including trip cancellation or interruption insurance, baggage insurance, and emergency medical expenses coverage for business trips. This can be especially beneficial for e-commerce entrepreneurs who frequently travel for conferences, trade shows, or to meet with suppliers. The peace of mind offered by knowing unexpected travel disruptions are covered can be invaluable.

Accident insurance, often included in travel packages, provides additional coverage in case of accidents during business travel.

Liability Insurance

Several business credit cards provide liability insurance coverage for various situations. This could include coverage for accidental damage caused to a client’s property during a delivery or for professional liability related to your business operations. While the coverage amounts vary between cards, this benefit can offer a valuable safety net, protecting your business from potentially devastating lawsuits. This is especially important for businesses operating in high-risk environments or dealing with valuable goods.

Other Valuable Perks

Beyond the above, other beneficial perks offered by some business credit cards include:* Cell Phone Protection: Coverage for damage or theft of your business cell phone.

Employee Card Programs

The ability to issue supplementary cards to employees for business expenses.

Early Payment Discounts

Incentives for paying your balance in full before the due date.

Digital Tools and Resources

Access to online tools for expense tracking and financial management.These additional benefits can significantly contribute to cost savings and improved business operations. For example, the cell phone protection can save you the cost of replacing a damaged or stolen phone, while employee card programs streamline expense management and improve accountability. Access to digital tools can simplify financial tracking, leading to better informed business decisions.

Scenario: Purchase Protection in Action

Imagine an e-commerce business specializing in selling high-end electronics. They purchase a large shipment of new laptops using their business credit card. Unfortunately, during transit, a significant portion of the shipment is damaged. With a business credit card offering purchase protection, the business can file a claim and potentially recover the cost of the damaged laptops, preventing a substantial financial loss and allowing them to fulfill existing orders without significant delay.

This exemplifies how a seemingly small perk can significantly impact the financial stability of an e-commerce business.

Selecting the optimal business credit card for your e-commerce enterprise hinges on a holistic assessment of your unique needs. By carefully weighing rewards programs, interest rates, credit limits, security features, and additional benefits, you can identify a card that not only streamlines your finances but also contributes to the long-term success and stability of your business. Remember, responsible credit card usage is essential for building a positive business credit profile, opening doors to future financing opportunities.

Empower your business with the right financial tool and watch it flourish.

FAQ Explained

What is a business credit score, and why is it important?

A business credit score reflects your company’s creditworthiness. Lenders use it to assess the risk of extending credit. A good score unlocks better loan terms and financing options.

Can I use my personal credit card for business expenses?

While possible, it’s generally not recommended. Mixing personal and business finances complicates accounting and can negatively impact your personal credit score.

How do I apply for a business credit card?

Application processes vary by issuer. Generally, you’ll need your business’s tax ID, financial statements, and information about business ownership.

What happens if my business credit card is compromised?

Report it immediately to your card issuer. Most cards offer zero liability protection for unauthorized transactions.