Compare Business Credit Cards for Large Purchases

Compare business credit cards with high credit limits for large purchases: Securing the right financing for significant business investments can be crucial for growth. This guide explores the landscape of high-limit business credit cards, examining key features, benefits, and considerations to help you make an informed decision. We’ll delve into comparing annual fees, interest rates, rewards programs, and the application process, equipping you with the knowledge to choose a card that aligns with your business needs and financial goals.

Understanding the nuances of business credit cards with high credit limits is paramount for responsible financial management. This involves not only evaluating the immediate benefits like purchase power and rewards but also carefully considering long-term implications such as interest rates, fees, and credit utilization. Making informed choices ensures that your business leverages these financial tools effectively without incurring unnecessary debt or compromising your creditworthiness.

Introduction to Business Credit Cards with High Credit Limits

Securing a business credit card with a high credit limit offers significant advantages for businesses, particularly those making substantial purchases or managing fluctuating cash flow. These cards provide a flexible financial tool that can streamline operations and potentially unlock valuable rewards. The higher limit offers peace of mind and avoids the disruption of managing multiple credit lines or frequent applications for credit increases.High credit limit business credit cards typically come with a range of features designed to benefit business owners.

These often include rewards programs, such as cash back, points, or miles, that can offset business expenses. Some cards provide purchase protection, extended warranties, and travel insurance, adding further value beyond the core credit function. Additionally, many offer robust online account management tools, allowing for easy tracking of expenses and payments.

Benefits of High Credit Limits for Large Purchases

A high credit limit significantly simplifies large business purchases. Instead of juggling multiple payments or seeking financing options, a high-limit card allows for consolidating expenses into a single, manageable payment. This streamlined approach reduces administrative burden and improves cash flow predictability. For instance, purchasing new equipment, investing in inventory, or covering unexpected repair costs becomes significantly easier with the financial flexibility a high credit limit provides.

The ability to make large purchases without impacting immediate operating capital is a key advantage.

Typical Features and Rewards of High-Limit Business Cards

Many high-limit business credit cards offer attractive rewards programs tailored to business spending. These can include tiered cash-back programs offering higher percentages on specific categories like office supplies or travel. Some cards accumulate points or miles redeemable for travel or merchandise, while others provide statement credits for specific business expenses. Beyond rewards, these cards often include features such as employee cards for expense management, purchase protection against damage or theft, and travel insurance for business trips.

The specific features and rewards vary widely between issuers and card types, so careful comparison is essential.

Examples of Situations Where a High Credit Limit is Advantageous

Several scenarios highlight the advantages of a high-limit business credit card. Consider a small construction company needing to purchase a new excavator costing tens of thousands of dollars. A high-limit card allows them to make the purchase without disrupting their cash flow, paying it off over time with manageable monthly payments. Similarly, a rapidly growing e-commerce business might need to increase its inventory significantly.

A high credit limit provides the financial flexibility to purchase a large amount of stock, ensuring sufficient inventory to meet customer demand without jeopardizing short-term liquidity. Finally, unexpected repairs or emergency expenses, such as a sudden need for HVAC system repair, can be covered without delaying operations or resorting to expensive short-term loans.

Key Factors to Compare

Choosing the right high-limit business credit card requires careful consideration of several key factors. These factors can significantly impact your business’s finances and overall operational efficiency. Understanding these differences is crucial for making an informed decision that aligns with your business needs.

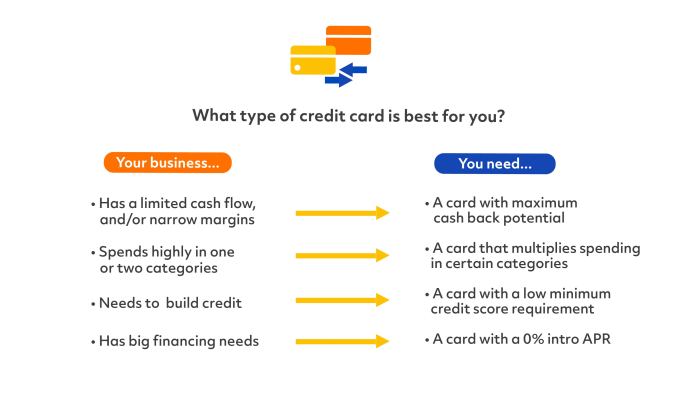

Annual Fees

Annual fees for high-limit business credit cards vary considerably. Some cards offer no annual fee, making them attractive to businesses operating on tighter budgets. Others may charge several hundred dollars annually, often in exchange for premium benefits. It’s essential to weigh the value of these benefits against the annual cost to determine if the card’s features justify the expense.

For example, a card with a $500 annual fee might offer extensive travel benefits or substantial rewards that could outweigh the cost for a frequently traveling business owner. Conversely, a business with minimal travel needs might find a no-annual-fee card a more financially prudent option.

Interest Rates and APRs

The interest rate, or Annual Percentage Rate (APR), is a critical factor. A high APR can quickly negate the benefits of a high credit limit if balances are carried month-to-month. Compare APRs across different cards carefully, paying attention to both the standard APR and any promotional APRs offered for a limited time. For instance, a card might offer a 0% introductory APR for the first 12 months, after which the rate jumps to a significantly higher percentage.

Understanding these variations allows businesses to make informed decisions about repayment strategies and potential interest charges.

Rewards Programs and Earning Potential

High-limit business credit cards often offer rewards programs, providing cashback, points, or miles on purchases. These rewards can be redeemed for travel, merchandise, or statement credits. However, the earning potential varies significantly between cards. Some cards might offer a flat rate of cashback on all purchases, while others offer higher rewards in specific spending categories, such as travel or office supplies.

Consider your business’s spending habits when evaluating the potential return on rewards. A business with high travel expenses, for instance, would benefit from a card offering high rewards on travel purchases.

Credit Score Requirements, Compare business credit cards with high credit limits for large purchases

Securing a high-limit business credit card typically requires a strong business credit score. Lenders use credit scores to assess the risk associated with extending credit. A higher credit score usually translates to better terms and higher credit limits. Businesses with lower credit scores may find it more challenging to qualify for these cards or may be offered less favorable terms, such as higher APRs or lower credit limits.

Improving your business credit score before applying can significantly increase your chances of approval for a desirable card with a high credit limit.

Specific Card Features & Benefits: Compare Business Credit Cards With High Credit Limits For Large Purchases

Choosing the right business credit card with a high credit limit involves carefully considering the specific features and benefits offered by different providers. Beyond the headline APR and credit limit, numerous details can significantly impact your business’s financial health and operational efficiency. Understanding these nuances is crucial for making an informed decision.

Business Credit Card Comparison

The following table compares four hypothetical business credit cards, highlighting key features to aid in your selection process. Remember that actual offers and terms can vary, so always check the issuer’s website for the most up-to-date information.

| Card Name | Annual Fee | APR (Variable) | Rewards Program | Other Significant Features |

|---|---|---|---|---|

| Business Platinum Card | $595 | 18.24% – 28.24% | 2x points on purchases, 5x points on flights and hotels booked through the portal. Annual $200 travel credit. | Purchase protection, extended warranty, concierge service |

| Business Rewards Card | $0 | 20.24% – 29.24% | 1.5% cash back on all purchases | Employee cards, online account management |

| Business Cash Back Card | $0 | 19.24% – 27.24% | 2% cash back on office supplies, 1% on all other purchases | No foreign transaction fees |

| Business Premier Card | $150 | 17.24% – 26.24% | 1 point per dollar spent, redeemable for travel, merchandise, or cash back. | Auto rental insurance, travel accident insurance |

Benefits of Purchase Protection and Extended Warranties

Purchase protection and extended warranties offered by some business credit cards provide valuable safeguards against unforeseen circumstances. Purchase protection typically covers items damaged or stolen within a specific timeframe after purchase, offering reimbursement or replacement. Extended warranties lengthen the manufacturer’s warranty, protecting against costly repairs or replacements. For example, a business purchasing expensive equipment could benefit significantly from the peace of mind provided by these features, mitigating potential financial losses from damage or early failure.

These benefits can translate to substantial cost savings over the life of the equipment.

Implications of Grace Periods and Payment Due Dates

Understanding grace periods and payment due dates is critical for effective cash flow management. The grace period is the time between the end of your billing cycle and the payment due date. A longer grace period allows more time to manage funds and avoid late payment fees. Different cards offer varying grace periods (e.g., 21 days, 25 days).

Paying your balance in full within the grace period avoids accruing interest charges. Missing the payment due date can result in late fees and negatively impact your credit score, potentially affecting your ability to secure future financing. Consistent on-time payments are essential for maintaining a strong credit profile.

Examples of Business Rewards Program Benefits

Different rewards programs cater to specific business needs. Cash back programs provide a straightforward return on spending, directly reducing business expenses. For example, a restaurant could earn significant cash back on their food supply purchases. Points-based programs offer flexibility, allowing redemption for travel, merchandise, or statement credits. A company with frequent travel needs could accumulate points for free flights or hotel stays.

Miles-based programs are similar to points programs but specifically focused on travel rewards. A company with a sales team frequently traveling to meet clients could leverage miles to significantly reduce travel costs. The optimal rewards program depends on the business’s spending patterns and priorities.

Application and Approval Process

Securing a high-limit business credit card involves a more rigorous application and approval process than for personal cards. Lenders carefully assess your business’s financial health and creditworthiness to minimize risk. Understanding this process can significantly improve your chances of approval.The typical application process begins with completing an online or paper application form. This form requests detailed information about your business, including its legal structure, history, revenue, and expenses.

After submission, the lender will review your application and supporting documentation. This review can take several days or even weeks, depending on the complexity of your business and the lender’s workload.

Factors Considered During Approval

Lenders use a multifaceted approach to evaluate applications for high-limit business credit cards. Key factors include your business’s credit history, financial strength, and the applicant’s personal credit score. A strong credit history, demonstrated by consistent on-time payments and low debt utilization, is crucial. Similarly, robust financials, including healthy revenue and manageable debt, significantly enhance approval odds. The lender will also scrutinize your business plan and industry to gauge its long-term viability and risk profile.

Finally, your personal credit score plays a role, particularly for sole proprietorships or small businesses with limited operational history.

Required Documents for Application

A comprehensive application typically requires several documents. Providing all necessary materials promptly can expedite the approval process. Incomplete applications often lead to delays or rejections.

- Business Application Form: This form gathers detailed information about your business, including its legal structure, address, and contact information.

- Articles of Incorporation or Partnership Agreement: Legal documents establishing your business’s existence and structure.

- Business Tax Returns (e.g., IRS Form 1120, 1065, or Schedule C): These documents showcase your business’s financial performance over the past few years.

- Profit and Loss Statement (P&L): A summary of your business’s revenues and expenses for a specific period.

- Balance Sheet: A snapshot of your business’s assets, liabilities, and equity at a specific point in time.

- Personal Credit Report: Lenders often require this to assess the creditworthiness of the business owner(s).

- Bank Statements: Demonstrate your business’s cash flow and financial stability.

- Business Licenses and Permits: Proof that your business operates legally and complies with relevant regulations.

Managing a High-Limit Business Credit Card Account

Effective management of a high-limit business credit card is paramount to maintaining a good credit rating and avoiding financial difficulties. This includes regular monitoring of transactions, prompt payment of balances, and responsible spending habits.

- Regular Statement Review: Scrutinize your monthly statements for accuracy and identify any unauthorized transactions immediately.

- On-Time Payments: Always pay your balance in full or at least the minimum payment by the due date to avoid late fees and damage to your credit score. Setting up automatic payments can help ensure timely payments.

- Budgeting and Spending Control: Establish a budget for business expenses and track your spending to avoid exceeding your credit limit. Using budgeting tools and expense tracking apps can assist in this process.

- Regular Credit Monitoring: Monitor your business credit reports regularly to detect any errors or signs of fraudulent activity.

- Consider a Rewards Program: If you choose a rewards card, maximize the rewards by using the card for eligible purchases and redeeming points or cashback strategically.

Ultimately, selecting the optimal high-limit business credit card hinges on a thorough assessment of your business’s unique financial profile and spending habits. By carefully weighing annual fees against rewards potential, understanding interest rates and APRs, and considering the application requirements, you can confidently choose a card that facilitates your business’s growth while maintaining responsible financial practices. Remember to proactively manage your account, monitor credit utilization, and leverage the available resources to maximize the benefits and minimize potential risks.

Essential Questionnaire

What is the impact of a high credit utilization ratio on my business credit score?

A high credit utilization ratio (the amount of credit used compared to your total available credit) negatively impacts your business credit score. Keeping utilization below 30% is generally recommended.

Can I use a business credit card for personal expenses?

While some cards might not explicitly prohibit personal use, it’s generally best practice to keep business and personal expenses separate for better accounting and credit management. Commingling funds can complicate tax preparation and potentially impact your credit score.

What happens if I miss a payment on my business credit card?

Missing payments will result in late fees and a negative impact on your business credit score. It can also increase your interest rate and make it harder to obtain credit in the future.

How long does the application process typically take?

The application process varies depending on the lender and your financial situation. It can range from a few days to several weeks.