Leveraging Credit Cards for Business Success

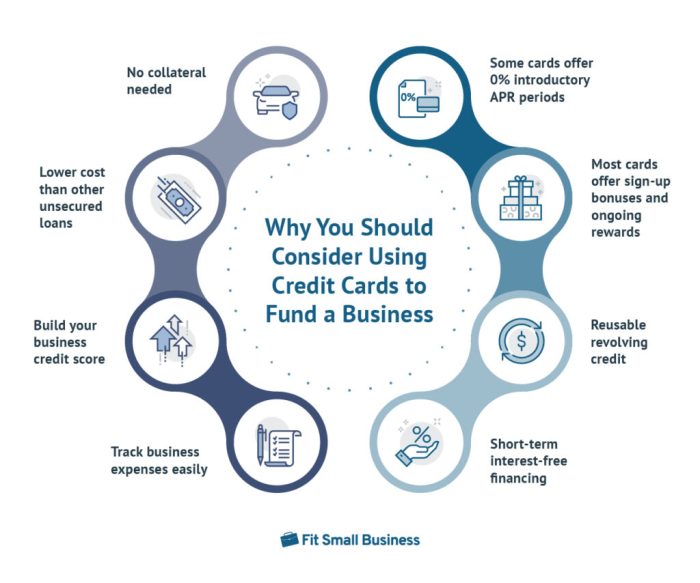

Leveraging credit cards for business expenses and cash flow management is a powerful strategy, but requires careful planning and execution. This guide explores how to strategically use business credit cards to optimize expenses, maximize rewards, and improve overall cash flow. We’ll delve into selecting the right card, budgeting effectively, mitigating risks, and building a strong business credit profile. Understanding these elements is key to harnessing the financial advantages credit cards offer businesses of all sizes.

From comparing different business credit card options and understanding their associated fees and rewards programs, to developing strategies for maximizing rewards and managing cash flow effectively, this comprehensive guide provides actionable steps and practical advice to help you navigate the complexities of using credit cards for your business. We will also address the importance of responsible credit card usage and maintaining accurate financial records to prevent potential pitfalls and build a positive business credit history.

Optimizing Credit Card Use for Business Expenses

Effectively managing business credit cards requires a strategic approach to maximize benefits and minimize risks. This involves careful expense categorization for tax purposes, strategic reward point accumulation, and disciplined budgeting and repayment. By optimizing these areas, businesses can leverage credit cards to improve their financial health.

Categorizing Business Expenses for Tax Purposes

Accurate expense categorization is crucial for simplifying tax preparation and ensuring compliance. A well-organized system allows for easy identification of deductible expenses and prevents potential audits. Begin by establishing a clear and consistent coding system for all transactions. This might involve using a simple numerical or alphabetical code to represent different expense categories (e.g., 1000 – Office Supplies, 2000 – Travel, 3000 – Marketing).

Each transaction should be meticulously recorded with its corresponding category code. Regularly reconcile your credit card statements with your accounting software to ensure accuracy and identify any discrepancies. Consider using accounting software that integrates directly with your credit card provider to automate this process. This streamlined approach minimizes errors and saves significant time during tax season.

Maximizing Rewards Points or Cashback Benefits

Many business credit cards offer substantial rewards programs. Understanding these programs and aligning spending habits with reward structures can significantly increase returns. For example, some cards offer higher cashback percentages on specific categories like travel or office supplies. Prioritize using your business credit card for expenses that fall within these high-reward categories. If your business frequently books flights and hotels, explore cards with travel-focused rewards.

Similarly, if your business relies heavily on software subscriptions, choose a card offering bonus rewards in that area. Keep track of your spending and rewards accumulation to ensure you are maximizing your returns. Compare different business credit card offers to identify the best fit for your business’s spending patterns. Consider rotating credit cards strategically to take advantage of different reward structures.

Sample Monthly Budget Incorporating Business Credit Card Spending

A well-structured budget is essential for responsible credit card usage. This example budget illustrates how to incorporate credit card spending and repayment plans.

| Category | Estimated Spending | Payment Source |

|---|---|---|

| Office Supplies | $500 | Business Credit Card |

| Marketing | $1000 | Business Credit Card |

| Travel | $750 | Business Credit Card |

| Software Subscriptions | $250 | Business Credit Card |

| Salaries | $5000 | Business Checking Account |

| Rent | $2000 | Business Checking Account |

| Utilities | $300 | Business Checking Account |

| Total Expenses | $10,300 | |

| Credit Card Payment | $2,500 | Business Checking Account |

Note: This is a sample budget and should be adjusted based on your specific business expenses and revenue. The credit card payment amount should be sufficient to avoid accumulating high interest charges. Aim for paying off your balance in full each month whenever possible.

Cash Flow Management with Business Credit Cards

Smart use of business credit cards can significantly enhance your company’s cash flow, providing a flexible financial tool to navigate the complexities of running a business. By strategically leveraging credit, businesses can optimize their spending and bridge gaps between income and expenses, leading to improved financial stability. This is particularly beneficial during periods of fluctuating revenue.Business credit cards offer a powerful mechanism for managing cash flow, especially when dealing with seasonal variations in revenue.

For example, a retail business might experience significantly higher sales during the holiday season, followed by a quieter period in the early months of the new year. Using a business credit card during the busy season allows the business to purchase inventory and cover operational expenses without depleting its cash reserves. The business can then repay the credit card balance during the less busy months, smoothing out the peaks and valleys of its cash flow.

This controlled approach to spending enables better financial planning and reduces the risk of cash shortages.

Managing Seasonal Revenue Fluctuations, Leveraging credit cards for business expenses and cash flow management

Seasonal businesses often face challenges in maintaining consistent cash flow. Revenue streams can be highly unpredictable, leading to periods of high income followed by significant drops. A business credit card can help mitigate these fluctuations by providing a line of credit to cover expenses during low-revenue periods. For instance, a landscaping company might use its business credit card to pay for fuel and equipment maintenance during the winter months, when work is less abundant.

They can then repay the card when business picks up in the spring and summer. This strategy allows the business to maintain its operations and meet its financial obligations without resorting to drastic measures like layoffs or service reductions.

Risks of Overspending and High Credit Card Debt

While business credit cards offer many advantages, it’s crucial to acknowledge the potential risks associated with overspending and accumulating high debt. Improper management can lead to serious financial difficulties.

- High Interest Charges: Failing to pay the balance in full each month can result in accumulating significant interest charges, impacting profitability and potentially leading to a debt cycle.

- Negative Impact on Credit Score: Consistent late payments or exceeding the credit limit can negatively affect the business’s credit score, making it harder to secure loans or other forms of financing in the future.

- Cash Flow Problems: While credit cards can improve cash flow, overreliance on credit and failing to manage repayments effectively can create severe cash flow issues, potentially leading to insolvency.

- Financial Stress and Business Instability: The pressure of managing high credit card debt can create significant financial stress, impacting decision-making and potentially leading to business instability.

Mitigating Risks of Overspending

Proactive budgeting and disciplined spending habits are essential for mitigating the risks associated with business credit card use. A well-defined budget, coupled with careful monitoring of expenses, helps prevent overspending and ensures that credit card debt remains manageable.

- Create a Detailed Budget: Develop a comprehensive budget that Artikels all anticipated income and expenses. This budget should include both fixed and variable costs, and it should be reviewed and adjusted regularly.

- Track Expenses Closely: Monitor credit card transactions regularly to ensure that spending remains within the allocated budget. Utilize online banking tools and apps to track expenses and identify areas where spending can be optimized.

- Set Spending Limits: Establish clear spending limits for each category of expenses. This helps prevent impulsive purchases and ensures that spending remains aligned with the overall budget.

- Prioritize Payments: Prioritize credit card payments to avoid late fees and high interest charges. Consider automating payments to ensure timely repayments.

- Explore Rewards Programs: Leverage rewards programs offered by business credit cards to earn cashback or other incentives on business expenses. This can help offset some of the costs associated with credit card use.

Reconciling Business Credit Card Statements: Leveraging Credit Cards For Business Expenses And Cash Flow Management

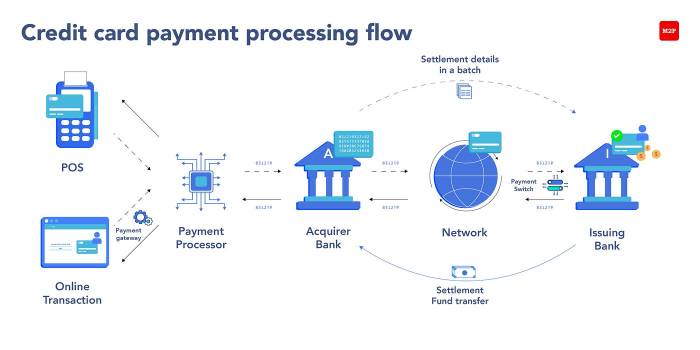

Reconciling your business credit card statements is a crucial step in maintaining accurate financial records and ensuring the smooth operation of your business. Accurate reconciliation helps identify discrepancies, prevents fraud, and provides a clear picture of your business’s financial health. This process involves comparing your credit card statement to your internal records – typically your accounting software or a spreadsheet – to ensure they match.

Any differences need investigation and resolution.Reconciling Business Credit Card Statements with Accounting SoftwareReconciliation involves systematically comparing your business credit card statement against your accounting records. Let’s assume you use accounting software. First, download your business credit card statement in a format compatible with your accounting software (e.g., CSV or QFX). Then, import the statement into your software.

The software will typically match transactions automatically based on date, amount, and description. However, manual review is essential.

Manual Review of Transactions

A visual comparison is necessary. Imagine your software highlights a transaction for $150 to “Office Supplies” on your statement, but your accounting records show only $100 for the same description and date. This discrepancy needs investigation. You might check your physical receipts or your purchase order records to find the missing $50. Perhaps the $50 was for a separate purchase, incorrectly grouped by the credit card company.

After investigating, you would adjust your accounting software to reflect the correct amount and ensure proper categorization. This process involves scrutinizing each transaction, ensuring accuracy and proper accounting.

Identifying and Correcting Common Errors

Common errors during reconciliation include:

- Data Entry Errors: Incorrectly entering transaction amounts or dates in your accounting software. Solution: Double-check all entries for accuracy.

- Timing Differences: Transactions posted to your credit card statement might not immediately appear in your accounting system. Solution: Allow for a few days’ lag before reconciliation.

- Categorization Errors: Incorrectly categorizing transactions can skew your financial reports. Solution: Use a consistent and detailed chart of accounts.

- Duplicate Entries: Accidentally recording the same transaction twice in your accounting system. Solution: Carefully review transactions for duplicates before reconciliation.

- Missing Transactions: Transactions appearing on your credit card statement but not recorded in your accounting system. Solution: Investigate the missing transaction using the credit card statement description and date. A physical receipt may be needed.

Best Practices for Maintaining Accurate Records

Maintaining accurate records is crucial for successful reconciliation.

- Detailed Record Keeping: Keep detailed receipts for every business expense. These receipts should include the date, vendor, amount, and a clear description of the purchase.

- Regular Reconciliation: Reconcile your credit card statement at least monthly to catch errors promptly. The sooner errors are identified, the easier they are to correct.

- Automated Reconciliation Tools: Explore using accounting software with automated reconciliation features. While manual review is always necessary, these tools can significantly reduce the time and effort required.

- Regular Software Updates: Keep your accounting software updated to ensure compatibility with your credit card provider and access to the latest features.

- Separate Business and Personal Accounts: Maintaining separate credit cards for business and personal expenses simplifies reconciliation and improves financial organization.

Successfully leveraging business credit cards requires a balanced approach: maximizing the benefits while mitigating the risks. By carefully selecting a card that aligns with your business needs, diligently tracking expenses, and proactively managing your budget, you can transform your credit card from a simple payment tool into a powerful asset for boosting cash flow and building a strong financial foundation for your business.

Remember, responsible spending and meticulous record-keeping are paramount to reaping the rewards and avoiding potential debt.

General Inquiries

What happens if I miss a credit card payment?

Missing a payment can result in late fees, a damaged credit score, and potentially higher interest rates. It’s crucial to make payments on time.

Can I use a personal credit card for business expenses?

While possible, it’s generally not recommended. Using a personal card for business expenses can complicate accounting, tax preparation, and may affect your personal credit score.

How often should I reconcile my business credit card statement?

Reconciling your statement monthly is best practice to catch errors early and maintain accurate financial records.

What is a good business credit score?

A good business credit score generally falls within the high 700s to 800s range, although the exact scoring system varies.