Credit Card Rewards Maximizing Business Benefits

Credit card rewards programs maximizing benefits for business expenses offer a compelling opportunity for savvy entrepreneurs. Strategic use of business credit cards can transform ordinary expenses into valuable rewards, potentially boosting profitability and fueling business growth. This exploration delves into the intricacies of selecting the right card, optimizing spending habits, and effectively managing rewards to achieve significant financial gains.

This guide provides a practical framework for navigating the world of business credit card rewards. We’ll examine key factors to consider when choosing a card, demonstrate how to strategically allocate spending to maximize returns, and Artikel effective strategies for tracking and redeeming earned rewards. Furthermore, we will address potential pitfalls and offer solutions for managing credit card debt while continuing to benefit from rewards programs.

Choosing the Right Credit Card for Business Expenses: Credit Card Rewards Programs Maximizing Benefits For Business Expenses

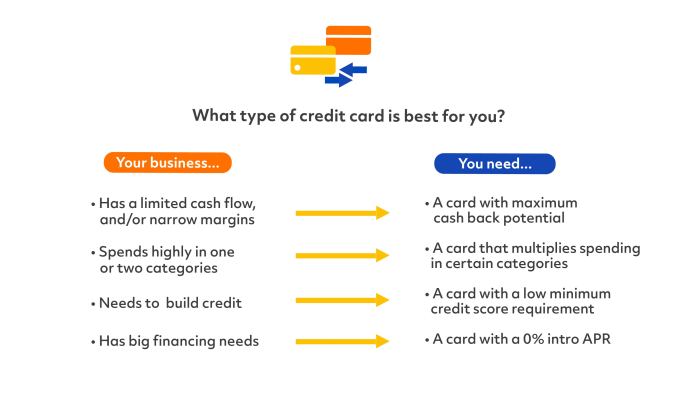

Selecting the appropriate business credit card can significantly impact your financial health and reward potential. Understanding the nuances of different card offerings is crucial for maximizing returns and minimizing costs. This section will guide you through the process of choosing a card that best suits your business needs.

Comparison of Business Credit Cards, Credit card rewards programs maximizing benefits for business expenses

The market offers a variety of business credit cards, each with unique features and benefits. Careful consideration of rewards programs, annual fees, and interest rates is vital for making an informed decision. The following table compares five popular options, but remember that specific terms and conditions are subject to change. Always refer to the issuer’s website for the most up-to-date information.

| Card Name | Rewards Program Details | Annual Fee | Interest Rate (APR) |

|---|---|---|---|

| Chase Ink Business Preferred® Credit Card | 5x points on the first $250,000 spent in combined purchases each account anniversary year on purchases of internet, cable, and phone services; 2x points on the next $250,000 spent in combined purchases each account anniversary year on purchases at restaurants, at office supply stores, and on flights and hotels; 1x point on all other purchases. | $95 | Variable, check Chase website for current rate. |

| American Express® Blue Business Plus® Credit Card | 2x Membership Rewards® points on the first $50,000 in purchases each calendar year, then 1x point on all other purchases. | $0 | Variable, check Amex website for current rate. |

| Capital One Spark Miles for Business | Unlimited 2x miles on every purchase. | $0 (for the Spark Miles Select) or $95 (for the Spark Miles Preferred). | Variable, check Capital One website for current rate. |

| Ink Business Cash Credit Card | 5% cash back on the first $25,000 spent in combined purchases each account anniversary year on purchases of internet, cable, and phone services; 2% cash back on the next $25,000 spent in combined purchases each account anniversary year on purchases at restaurants, at office supply stores, and on flights and hotels; 1% cash back on all other purchases. | $0 | Variable, check Chase website for current rate. |

| U.S. Bank Business Leverage Visa Signature® Card | Earn 1.5% cash back on all purchases. | $0 | Variable, check U.S. Bank website for current rate. |

Key Factors in Credit Card Selection

Business owners should prioritize three key factors when choosing a business credit card: the rewards program’s alignment with business spending habits, the overall cost of the card (including annual fees and interest), and the credit card’s benefits beyond rewards.

Understanding Rewards Program Terms and Conditions

Before applying for any business credit card, meticulously review the terms and conditions of the rewards program. Pay close attention to aspects such as earning rates, redemption options, expiration dates for points or miles, and any limitations or restrictions on earning or redeeming rewards. For example, some programs might restrict bonus categories to specific vendors or limit the amount of rewards you can earn within a certain period.

Ignoring these details can lead to disappointment and a less-than-optimal return on your spending.

Optimizing Spending for Maximum Rewards

Maximizing your business credit card rewards requires a strategic approach to spending. It’s not just about using the card; it’s about consciously directing your expenses to categories that offer the highest rewards rates. By carefully planning your monthly budget and understanding your card’s reward structure, you can significantly boost your return on investment.Understanding your credit card’s rewards structure is paramount.

Many cards offer bonus categories, such as higher rewards for travel, office supplies, or specific vendors. Others might offer a flat rate across all purchases. Knowing which categories offer the highest rewards for your business will allow you to prioritize spending in those areas.

Sample Monthly Budget for a Small Business

This sample budget illustrates how to strategically allocate expenses to maximize credit card rewards, assuming a credit card with bonus categories for travel (5x points), office supplies (3x points), and dining (2x points), and a base rate of 1x point for all other purchases. Remember to adapt this to your specific business needs and your chosen credit card’s rewards program.

| Expense Category | Monthly Budget | Reward Category | Estimated Points Earned |

|---|---|---|---|

| Office Supplies (printing, stationery) | $500 | 3x | 1500 points |

| Travel (flights, hotels for conferences) | $1000 | 5x | 5000 points |

| Employee Reimbursements (meals, transportation) | $300 | 2x (if dining) / 1x (otherwise) | 600 points (assuming half for dining) |

| Marketing & Advertising (online ads) | $700 | 1x | 700 points |

| Software Subscriptions | $200 | 1x | 200 points |

| Utilities | $100 | 1x | 100 points |

| Rent | $1500 | 1x | 1500 points |

| Total | $4800 | 10600 points |

Practical Tips for Everyday Business Expenses

Using your business credit card effectively for everyday expenses involves more than simply swiping. Consider these practical tips:* Consolidate Purchases: Bundle similar purchases whenever possible to maximize rewards in bonus categories. For example, purchase all your office supplies at once.

Utilize Employee Reimbursement Programs

If your employees use personal cards for business expenses, establish a clear reimbursement process, ensuring they use receipts and submit claims promptly. This allows you to earn rewards on these expenses.

Explore Vendor Partnerships

Many credit card companies partner with specific vendors, offering increased rewards for purchases made through those vendors. Research these partnerships to optimize your spending.

Track Your Spending

Use your credit card’s online portal or a budgeting app to monitor your spending and rewards accumulation. This helps you stay on track with your goals and identify areas for improvement.

Examples of Eligible and Excluded Expenses

Understanding which expenses qualify for rewards is crucial.

Eligible for Rewards:

- Office supplies (paper, pens, printer ink)

- Travel expenses (flights, hotels, car rentals for business trips)

- Marketing and advertising (online ads, print materials)

- Software subscriptions (accounting software, project management tools)

- Professional services (consultants, lawyers)

- Employee reimbursements (business-related meals, transportation)

Typically Excluded from Rewards:

- Cash advances

- Balance transfers

- Interest payments

- Certain types of fees (late payment fees, annual fees)

- Personal expenses (groceries, entertainment unless directly related to business)

Tracking and Redeeming Rewards

Effectively managing your business credit card rewards requires a robust tracking system and a clear understanding of your redemption options. This section Artikels strategies for maximizing your return on investment by meticulously monitoring earned rewards and strategically choosing how to utilize them. Careful planning in these areas ensures your business benefits fully from its credit card program.

Tracking and redeeming rewards efficiently are crucial steps in maximizing the value of your business credit card. A well-organized system allows you to monitor progress toward rewards goals and make informed decisions about how to use your accumulated points or cash back. This process involves both meticulous record-keeping and strategic planning for redemption.

Credit Card Reward Tracking Methods

Several methods exist for effectively tracking credit card rewards earned from business expenses. Choosing the right method depends on your personal preferences and the complexity of your spending habits. Consistency is key, regardless of the method chosen.

Many individuals find success using a combination of methods to ensure complete and accurate tracking. This often involves leveraging both digital tools and manual record-keeping to provide a comprehensive overview of reward accumulation.

- Spreadsheet Tracking: A simple spreadsheet can be created to manually log each transaction, noting the date, merchant, amount spent, and rewards earned. This allows for detailed analysis of spending patterns and reward accumulation over time.

- Credit Card Company Portals: Most credit card companies provide online portals that display your transaction history and accumulated rewards. Regularly reviewing this portal allows for real-time tracking of your progress.

- Reward Tracking Apps: Numerous mobile applications are designed specifically for tracking rewards across multiple credit cards. These apps often provide features such as automated import of transaction data and personalized reward redemption recommendations.

- Accounting Software Integration: If you use accounting software for your business, some platforms allow for integration with your credit card accounts, automatically importing transaction data and calculating reward accumulation.

Reward Redemption Options

Credit card rewards programs typically offer a variety of redemption options, each with its own set of advantages and disadvantages. Understanding these options is crucial for maximizing the value of your rewards. The best option depends on your business needs and spending priorities.

Careful consideration of the value proposition of each redemption option is crucial for maximizing the return on your rewards. Comparing the cash value of the rewards to the cost of the goods or services being purchased is a useful approach.

- Cash Back: This is a straightforward option where rewards are redeemed for a direct cash payment credited to your account or received as a check. The value is typically fixed at a certain percentage of spending.

- Travel Rewards: Many cards offer points or miles that can be redeemed for flights, hotel stays, or other travel-related expenses. The value of travel rewards can fluctuate depending on the time of year and availability, but can often provide significant value if redeemed strategically.

- Merchandise: Some programs allow you to redeem rewards for merchandise from a catalog of items. While convenient, the value proposition of merchandise redemption can often be less than other options.

- Statement Credits: This option applies your rewards directly to your credit card statement, reducing your outstanding balance. This provides immediate financial benefit and is particularly useful for managing business expenses.

Redeeming Rewards for Business Expenses

Redeeming rewards for business-related expenses can significantly reduce operational costs. This requires careful planning and a focus on expenses that align with your reward program’s offerings.

Planning ahead is essential to maximize the impact of reward redemptions on your business’s bottom line. Prioritizing expenses that can be offset with rewards allows for substantial savings.

- Airline Tickets: Redeeming rewards for airline tickets for business travel is a common and effective strategy. This can represent significant savings, particularly for frequent travelers.

- Office Equipment: Some programs allow you to redeem rewards for office equipment such as computers, printers, or other necessary supplies. This can provide substantial cost savings compared to purchasing these items outright.

- Software Licenses: Depending on the reward program, you might be able to redeem points or miles for software licenses or subscriptions, reducing software costs for your business.

- Conference Registrations: If your business attends industry conferences, redeeming rewards for conference registration fees can lead to significant cost savings.

Avoiding Credit Card Pitfalls

Successfully leveraging business credit cards for rewards requires a proactive approach to risk management. Understanding and mitigating potential downsides is crucial for maximizing benefits and maintaining financial health. Ignoring these pitfalls can quickly negate any rewards earned and lead to significant financial strain.High balances on business credit cards significantly impact rewards maximization. Interest charges consume a substantial portion of your available funds, effectively reducing the value of any rewards earned.

For instance, if you’re paying 20% annual interest on a $10,000 balance, that’s $2,000 annually diverted from potential rewards or other business needs. This severely diminishes the return on investment from your credit card program. The higher the balance, the more pronounced this effect becomes, potentially making rewards programs financially disadvantageous.

High Balance Impacts on Rewards

Carrying a high balance directly reduces the net benefit of rewards programs. The interest paid often outweighs the value of the rewards received, rendering the program ineffective. Effective management involves paying down balances promptly and strategically, prioritizing high-interest debt to minimize the financial burden. Regularly reviewing statements and utilizing online banking tools helps in tracking spending and ensuring timely payments.

Consider setting up automatic payments to avoid late fees and maintain a positive credit history, further strengthening your negotiating power with future credit applications.

Common Business Credit Card Mistakes

Businesses often fall into traps when managing credit card expenses. These mistakes can range from poor record-keeping to overlooking important terms and conditions. For example, neglecting to track expenses meticulously can lead to difficulties in reconciling accounts and claiming tax deductions. Furthermore, failing to read the fine print regarding fees, interest rates, and rewards programs can result in unexpected charges and diminished returns.

Finally, authorizing too many employees to use a single card without proper oversight can lead to fraudulent activity or misuse of funds.

Effective Credit Card Debt Management

Managing credit card debt while maximizing rewards requires a balanced approach. Prioritize paying down high-interest debt aggressively to reduce the financial burden of interest charges. This allows more of your available funds to be used for business growth or to accumulate rewards. Explore balance transfer options to lower interest rates, though be mindful of any associated fees.

Developing a robust budgeting system and adhering to a disciplined payment schedule are critical for staying on top of expenses and avoiding accumulating excessive debt. Consider using budgeting apps or spreadsheets to track income, expenses, and debt payments effectively. By meticulously managing expenses and strategically prioritizing debt repayment, businesses can benefit from rewards programs while maintaining financial stability.

Mastering the art of leveraging credit card rewards for business expenses can significantly impact a company’s bottom line. By carefully selecting the right card, optimizing spending strategies, and diligently tracking rewards, businesses can unlock substantial financial advantages. From funding marketing initiatives to investing in employee training, the potential applications of accumulated rewards are vast. This strategic approach not only enhances financial efficiency but also positions businesses for sustainable growth and increased profitability.

FAQs

What is the best credit card for my small business?

The “best” card depends on your spending habits. Consider your typical monthly expenses and choose a card with a rewards structure that aligns with those. Compare annual fees and interest rates to ensure the rewards outweigh the costs.

Can I use rewards for personal expenses?

Generally, rewards earned on business cards are intended for business use. However, some programs may allow for personal use, but this often comes with limitations or restrictions. Always review your card’s terms and conditions.

What happens if I miss a credit card payment?

Missing payments will negatively impact your credit score and may result in late fees and higher interest rates. This can significantly diminish the benefits of the rewards program.

Are there tax implications for using credit card rewards?

Yes, the tax implications depend on how the rewards are used. Consult a tax professional for guidance on the specific tax treatment of your rewards redemption.