The risks and rewards of using credit cards for business capital

The risks and rewards of using credit cards for business capital are a critical consideration for any entrepreneur. While credit cards offer a readily accessible source of short-term funding, potentially boosting cash flow and enabling immediate purchases, they also carry the significant risk of accumulating substantial debt and damaging credit scores if not managed prudently. This exploration delves into the strategic use of business credit cards, highlighting both their potential benefits and the pitfalls to avoid.

Understanding the nuances of business credit card usage requires careful analysis of available options, including different card types, associated fees and interest rates, and the potential rewards programs. Effective management of credit card debt, through budgeting and strategic repayment plans, is crucial to preventing financial distress. Finally, a comparison with alternative funding sources, such as small business loans and lines of credit, helps determine the most appropriate financing strategy for individual business needs and risk tolerance.

Accessing Capital Through Credit Cards

Credit cards can be a valuable tool for businesses seeking short-term financing, offering quick access to funds for immediate needs. However, relying on credit cards for long-term capital solutions can prove detrimental due to high interest rates and potential debt accumulation. Understanding both the advantages and limitations is crucial for effective financial management.Credit cards provide a readily available line of credit, useful for bridging short-term cash flow gaps and managing operational expenses.

This accessibility can be particularly beneficial for startups or small businesses with limited access to traditional funding sources. However, the convenience comes with a price – high interest rates and potential fees.

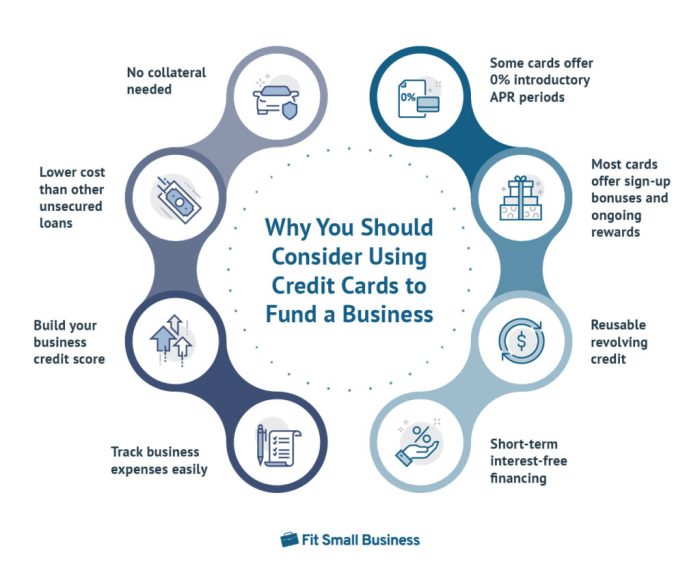

Advantages of Short-Term Financing with Credit Cards

Using business credit cards for short-term financing offers several key advantages. The speed and ease of access are unparalleled, allowing businesses to quickly cover unexpected expenses or seize time-sensitive opportunities. Furthermore, many cards offer rewards programs, potentially offsetting some of the costs through cashback or points accumulation on business purchases. Careful management of these cards can lead to a positive return on investment in the short term.

For instance, a business might use a credit card to purchase essential supplies needed for a rush order, securing the sale and earning revenue that quickly covers the credit card expense.

Limitations of Long-Term Financing with Credit Cards

The high interest rates associated with credit cards make them unsuitable for long-term financing. Carrying a large balance over an extended period can quickly lead to substantial debt, impacting the business’s profitability and financial health. The interest charges can significantly outweigh the benefits of using credit, making it a costly solution for larger capital investments. For example, using a credit card to finance a major piece of equipment with a long repayment period would likely result in excessive interest payments, compared to securing a business loan with a lower interest rate.

Effective Utilization of Credit Cards for Operational Expenses, The risks and rewards of using credit cards for business capital

Businesses can effectively leverage credit cards for operational expenses by focusing on short-term, manageable purchases. This includes covering immediate costs like supplies, marketing materials, or travel expenses, where the repayment period is short enough to avoid accumulating significant interest. A well-defined budget and disciplined repayment strategy are crucial. For example, a restaurant might use a credit card to purchase weekly food supplies, paying off the balance in full before the next billing cycle to avoid interest charges.

This ensures that the credit card remains a tool for efficient cash flow management, not a source of long-term debt.

Hypothetical Scenario: Business Credit Card Investment

Imagine a small bakery considering purchasing a new commercial oven costing $10,000. Using a business credit card with a 18% APR and a 12-month repayment plan, the total interest paid would be approximately $1,350, resulting in a total cost of $11,350. However, if the bakery secured a small business loan with a 7% APR over the same period, the total interest paid would be significantly lower, around $400, resulting in a total cost of $10,400.

This scenario clearly demonstrates the financial advantage of exploring alternative financing options for larger investments, showcasing the limitations of credit cards for long-term capital needs.

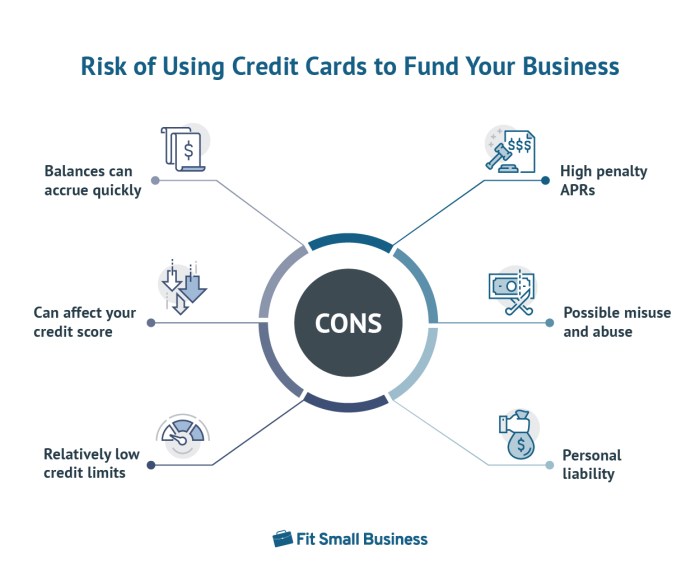

Managing Credit Card Debt for Businesses: The Risks And Rewards Of Using Credit Cards For Business Capital

Effectively managing business credit card debt is crucial for maintaining financial health and ensuring long-term success. High levels of debt can severely impact a business’s ability to grow and thrive, potentially leading to financial instability and even bankruptcy. Understanding the risks and implementing proactive strategies are essential for responsible credit card usage.High levels of business credit card debt present several significant risks.

The most immediate is the burden of high interest payments, which can quickly eat into profits and limit the funds available for reinvestment in the business. This can hinder growth and prevent the business from taking advantage of opportunities. Furthermore, excessive debt can negatively impact a business’s credit score, making it more difficult to secure loans or lines of credit in the future.

This financial constraint can severely limit expansion possibilities and even impact the ability to secure favorable terms with suppliers. Finally, the stress of managing substantial debt can impact the business owner’s well-being and negatively affect decision-making.

Strategies for Managing and Minimizing Business Credit Card Debt

Effective debt management involves a multi-pronged approach. First, creating a detailed budget is paramount. This allows businesses to track expenses and identify areas where spending can be reduced. Second, prioritizing high-interest debt repayment is crucial. Focusing on paying down the debts with the highest interest rates first minimizes the overall interest paid over time.

Third, exploring debt consolidation options can simplify repayment and potentially lower interest rates. This could involve transferring balances to a card with a lower APR or securing a business loan to pay off existing credit card debt. Finally, consistently monitoring credit reports and maintaining open communication with creditors is vital for early detection and resolution of any potential issues.

Creating a Realistic Budget to Control Business Credit Card Spending

A realistic budget is the cornerstone of effective credit card debt management. This involves a step-by-step process. First, meticulously track all business income and expenses for a period of at least three months. This provides a clear picture of the business’s financial inflows and outflows. Second, categorize expenses to identify areas of high spending.

This could involve separating categories like rent, utilities, marketing, supplies, and salaries. Third, set realistic spending limits for each category based on the data gathered. This ensures that spending remains within the allocated budget. Fourth, regularly review and adjust the budget as needed. Market fluctuations or unexpected expenses may require adjustments to maintain financial control.

Fifth, consistently monitor credit card statements to ensure spending remains within the budget limits. This proactive approach prevents the accumulation of excessive debt.

Resources Available to Businesses Struggling with Credit Card Debt

Several resources are available to assist businesses facing challenges with credit card debt. These include credit counseling agencies that provide guidance on debt management strategies and negotiate with creditors on behalf of the business. Small Business Administration (SBA) resources offer assistance with financial planning and access to government-backed loans. Local chambers of commerce often provide networking opportunities and connect businesses with relevant resources.

Finally, consulting with a financial advisor can provide personalized guidance and support in developing a tailored debt reduction plan. Seeking professional help can significantly improve the chances of successfully overcoming financial challenges.

Legal and Regulatory Considerations

Using business credit cards for financing offers advantages, but navigating the legal landscape is crucial for avoiding costly mistakes and maintaining compliance. Ignoring relevant laws and regulations can lead to significant financial penalties and damage your business’s reputation. Understanding the legal implications is paramount for responsible and sustainable business growth.Understanding relevant laws and regulations concerning business credit card usage is essential for responsible financial management and legal compliance.

Failure to comply can result in penalties, legal action, and reputational damage. These regulations vary depending on location and specific card agreements, necessitating careful review and adherence.

Business Credit Card Agreements

Business credit card agreements are legally binding contracts. Understanding the terms and conditions, including interest rates, fees, and repayment schedules, is crucial. Failure to adhere to these terms can result in late payment fees, increased interest charges, and potential legal action by the credit card issuer. Common issues include disputes over charges, unauthorized transactions, and misunderstandings regarding repayment terms.

Businesses should carefully read and understand all aspects of their credit card agreement before signing.

Compliance with Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) governs how credit information is collected, used, and shared. Businesses must ensure they comply with the FCRA when applying for and using business credit cards. This includes ensuring the accuracy of information provided on credit applications and understanding how credit reports impact their creditworthiness. Failure to comply can result in legal challenges and damage to credit scores.

Regularly reviewing credit reports and disputing any inaccuracies is a key aspect of FCRA compliance.

State and Federal Tax Laws

Using business credit cards for expenses necessitates careful tracking and documentation for tax purposes. Businesses must accurately categorize expenses, ensuring proper documentation for deductions and avoiding potential tax penalties. Understanding the implications of credit card interest charges and how they affect taxable income is also crucial. Failure to comply with state and federal tax laws related to business expenses can lead to audits, back taxes, and interest charges.

Maintaining meticulous records of all credit card transactions is vital for accurate tax reporting.

Steps to Ensure Compliance

To ensure compliance, businesses should thoroughly review their credit card agreements, maintain accurate records of all transactions, understand applicable tax laws, and promptly address any discrepancies or errors on their credit reports. Regularly reviewing financial statements and seeking professional advice from accountants and legal professionals can provide further assurance of compliance. Proactive compliance minimizes legal risks and promotes responsible financial management.

Ultimately, the decision of whether or not to utilize business credit cards for capital hinges on a careful assessment of risk versus reward. By understanding the various types of cards available, the associated costs and benefits, and by implementing sound financial management practices, businesses can leverage credit cards effectively to support growth while mitigating potential downsides. A proactive approach to debt management and a clear understanding of alternative funding options are essential for ensuring long-term financial stability and success.

Quick FAQs

What is the impact of late payments on my business credit score?

Late payments significantly damage your business credit score, making it harder to secure future loans or credit at favorable terms. It can also lead to increased interest rates and fees.

How can I choose the right business credit card for my needs?

Consider your spending habits, desired rewards, and your business’s creditworthiness. Compare APRs, fees, and rewards programs from different issuers to find the best fit. A card with a low APR is ideal if you anticipate carrying a balance.

What are some signs that I’m overusing my business credit card?

Signs include consistently carrying a high balance, struggling to make minimum payments, and relying on credit cards for essential expenses instead of operating capital.

What happens if my business defaults on a business credit card?

Defaulting can severely damage your business credit, leading to difficulty securing future funding and potential legal action from the credit card issuer. It can also negatively impact your personal credit if the card is a personal guarantee.