Credit Card Rewards Programs Compared and Contrasted

Credit card rewards programs compared and contrasted reveal a fascinating landscape of financial incentives. Understanding the nuances of cash back, points, and miles programs is crucial for maximizing financial benefits. This exploration delves into the various structures, strategies for optimization, and the often-overlooked aspects of fees and redemption values, empowering consumers to make informed choices.

From the simple allure of cash back to the complexities of travel rewards programs, the world of credit card rewards offers a multitude of options. This analysis provides a comprehensive comparison of various programs, examining their strengths and weaknesses to help individuals select the program that best aligns with their spending habits and financial goals. We’ll navigate the intricacies of earning and redeeming rewards, addressing common pitfalls and providing actionable strategies for maximizing returns.

Introduction to Credit Card Rewards Programs

Credit card rewards programs offer a compelling incentive for consumers to use their cards for everyday purchases. These programs transform spending into valuable rewards, effectively turning expenses into potential savings or experiences. Understanding the different types of programs and how they work is key to maximizing their benefits.Rewards programs operate on a points-based system. Cardholders earn points or miles for every dollar spent, with the accumulation rate varying depending on the card and spending category.

These points can then be redeemed for various rewards, ranging from statement credits and merchandise to travel and experiences. The specific value of each point or mile depends on the redemption method chosen and can fluctuate.

Types of Credit Card Rewards Programs

Credit card rewards programs are diverse, offering various reward structures to cater to different consumer preferences. Three common types are cash back, points, and miles. Cash back programs offer a straightforward return of a percentage of spending directly to the cardholder’s account. Points programs accumulate points that can be redeemed for a range of rewards, often with varying point values depending on the redemption option.

Miles programs, often affiliated with airline loyalty programs, allow for the redemption of accumulated miles for flights and other travel-related perks. Some cards even offer hybrid programs combining elements of these structures, such as cash back and points.

Earning and Redeeming Rewards

Earning rewards is typically straightforward. Most programs award a fixed number of points or miles per dollar spent on purchases. Some cards offer bonus categories, providing higher earning rates for spending in specific areas like groceries, gas, or travel. Redeeming rewards, however, can be more nuanced. The value of rewards can vary widely depending on how they are redeemed.

Redeeming for statement credits often provides the highest value, while merchandise or travel may offer lower value per point. Understanding the redemption options and their relative value is crucial for maximizing the benefits of a rewards program.

Examples of Reward Structures, Credit card rewards programs compared and contrasted

Consider three hypothetical cards: Card A offers 1% cash back on all purchases; Card B offers 2 points per dollar spent, with each point worth approximately $0.01 when redeemed for statement credit; and Card C offers 1 mile per dollar spent, with miles redeemable for flights. A $100 purchase on Card A would yield $1 in cash back. The same purchase on Card B would earn 200 points, equivalent to $2 in statement credit.

Card C would earn 100 miles, potentially enough for a portion of a flight, depending on the airline and destination. The actual value derived from each card depends on individual spending habits and redemption preferences.

Comparison of Rewards Categories

Choosing the right credit card often hinges on understanding the nuances of its rewards program. Different programs offer varying structures and benefits, making direct comparisons crucial for maximizing returns. This section delves into the key differences between various reward categories, focusing on cash back, travel rewards, and category-specific programs.

Cash Back Rewards Programs

Cash back rewards are straightforward: you earn a percentage of your spending back as cash. The appeal lies in its simplicity and versatility; the rewards are easily accessible and can be used for any purchase. However, cash back rates vary significantly across issuers and often depend on spending categories and the card’s tier. Some cards offer a flat rate across all purchases, while others provide higher percentages for specific spending categories (e.g., groceries or gas).

Furthermore, the redemption methods can also differ, with some offering statement credits while others might provide checks or direct deposit. Ultimately, the best cash back card depends on your spending habits and preferred redemption method.

Travel Rewards Programs

Travel rewards programs, using miles or points, provide a different approach to accumulating rewards. These programs often offer substantial value when redeemed for flights, hotels, or other travel-related expenses. However, they come with their own set of complexities. The value of miles and points can fluctuate based on availability and redemption options. Booking reward travel often requires careful planning and flexibility, as award seats and hotel rooms may be limited.

Furthermore, some travel rewards programs have complex earning structures and potentially high annual fees. Despite these drawbacks, for frequent travelers, strategically utilizing a travel rewards program can lead to significant savings on travel costs.

Category-Specific Rewards Programs

Many credit cards focus on rewarding spending in specific categories, such as groceries, gas, or dining. These programs often offer significantly higher rewards rates within those categories than general-purpose cards. The advantage is clear: if a significant portion of your spending falls within these categories, you can maximize your rewards. The disadvantage is that rewards are less flexible.

If your spending habits shift, the card might become less valuable. It’s crucial to evaluate your spending patterns before choosing a card with category-specific rewards.

Comparison of Four Credit Card Rewards Programs

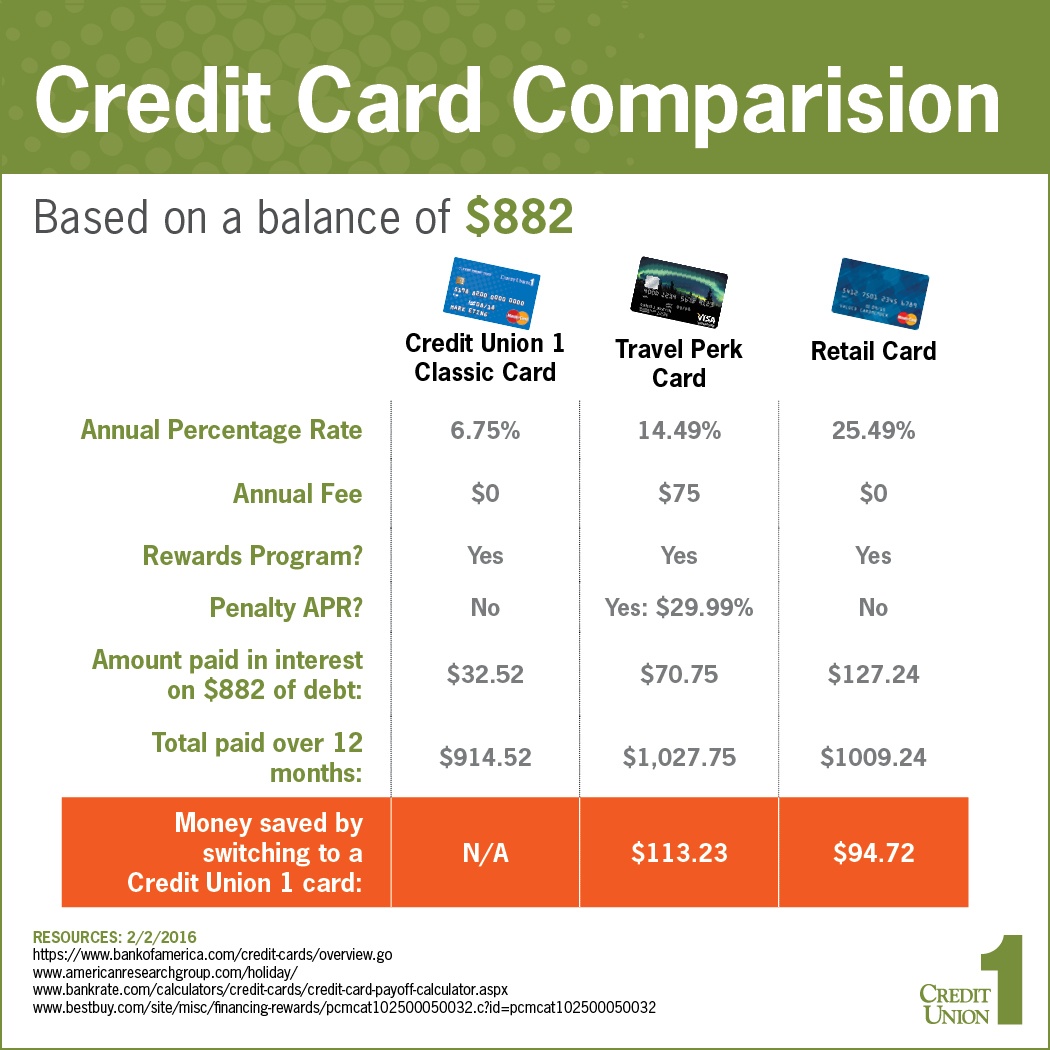

The following table compares four hypothetical credit card rewards programs to illustrate the variations in annual fees, rewards rates, and redemption options. Remember that actual programs and their terms can change, so always check the issuer’s website for the most up-to-date information.

| Card Name | Annual Fee | Rewards Rate | Redemption Options |

|---|---|---|---|

| CashBackMax | $0 | 1.5% cash back | Statement credit |

| TravelRewards Elite | $95 | 2x miles on travel, 1x mile on other purchases | Flights, hotels, car rentals |

| GroceryPlus | $0 | 3% cash back on groceries, 1% on other purchases | Statement credit |

| DiningRewards Platinum | $150 | 4x points on dining, 1x point on other purchases | Statement credit, travel |

Earning Rewards

Maximizing your credit card rewards requires a strategic approach tailored to your spending habits. Understanding how different rewards programs operate and employing smart spending techniques can significantly boost your earnings. This section explores strategies for optimizing your rewards potential.Understanding your spending patterns is the cornerstone of effective rewards maximization. By identifying where you spend the most money—groceries, gas, travel, dining, etc.—you can choose credit cards with bonus categories that align with your typical expenditures.

This targeted approach ensures you earn significantly more rewards than using a generic card.

Bonus Categories and Promotional Offers

Bonus categories, offering increased rewards points or cash back on specific purchases, are a powerful tool for accelerating rewards accumulation. Many cards offer rotating quarterly bonus categories, allowing you to switch your spending to maximize returns. For example, a card might offer 5% cash back on groceries for a quarter, then switch to 5% on travel purchases the next.

Promotional offers, such as welcome bonuses (often a large number of points or cash back after meeting a spending requirement within a certain timeframe) and limited-time bonus categories, further enhance rewards earning. Strategically utilizing these offers can substantially increase your overall rewards.

Strategic Use of Multiple Credit Cards

Employing multiple credit cards strategically can significantly amplify your rewards. This approach involves using the card with the highest rewards rate for each spending category. For instance, one card might offer superior rewards on groceries, while another excels in travel purchases. Careful tracking of spending and diligent payment management are essential for this strategy to be successful. Failing to manage multiple cards effectively can lead to missed payments and negatively impact your credit score.

For example, someone might use a card offering 5% cash back on groceries at their primary grocery store and a different card offering 2% cash back on all other purchases. This ensures they maximize rewards across all their spending.

Redeeming Rewards

Redeeming accumulated credit card rewards can be a rewarding experience, but navigating the various options and understanding their value is crucial to maximizing your return. Different programs offer diverse redemption methods, each with its own strengths and weaknesses. Careful consideration of these options is key to getting the most out of your hard-earned points or miles.Redemption options typically include travel, merchandise, cash back, and sometimes gift cards.

The value proposition of each option varies significantly depending on the program and the individual’s spending habits and travel preferences. Understanding these differences is critical to making informed decisions.

Reward Redemption Value Comparison

The value of your rewards isn’t always straightforward. A point or mile might be worth a different amount depending on how you redeem it. For instance, redeeming points for a flight might offer significantly better value than redeeming them for merchandise of equal point value. Cash back offers a consistent value, but often represents a lower overall return compared to strategic travel redemptions.

Merchandise redemption can be attractive for specific items but often lacks flexibility and may not always represent the best value for your points.

Redeeming Rewards for Travel

Redeeming rewards for travel often offers the highest value. Many programs allow you to book flights and hotels directly through their portals, often offering better pricing than booking independently. However, award availability can be limited, especially during peak travel seasons, and you may need to be flexible with your travel dates. The redemption process typically involves searching for available flights or hotels on the program’s website, selecting your preferred option, and then confirming your booking using your accumulated points or miles.

It’s essential to compare the value of the travel reward to the cash price to ensure you are getting a good deal. For example, a flight that costs $500 but only requires 25,000 points might be a better deal than using the same points for a $200 merchandise item.

Redeeming Rewards for Merchandise

Redeeming rewards for merchandise offers a straightforward approach, allowing you to choose from a catalog of available items. However, the value proposition is often less favorable compared to travel redemptions. The value of your points or miles is typically lower when exchanged for merchandise. The process involves browsing the rewards catalog, selecting your desired item, and then redeeming your points to complete the purchase.

This option is best suited for those seeking specific items, rather than maximizing the overall value of their rewards.

Redeeming Rewards for Cash Back

Cash back redemption offers a simple and consistent value proposition. Your accumulated points or miles are converted directly into a cash credit applied to your credit card account or received via check. While convenient, this method often provides the lowest return on your accumulated rewards compared to travel or strategic merchandise redemptions. The process typically involves selecting the cash back option on your rewards program website and specifying the amount you wish to redeem.

This option is best for those who prioritize simplicity and immediate value, rather than maximizing the potential return on their rewards.

Pitfalls of Less-Than-Optimal Redemption

Redeeming rewards without considering the value proposition can lead to significant losses. For example, using 50,000 points for a $200 gift card when the same points could have secured a $1000 flight represents a considerable loss of potential value. Failing to plan ahead and book travel in advance can also result in limited award availability and higher redemption costs.

Similarly, redeeming for less desirable merchandise can lead to a diminished return on investment compared to cash back or travel rewards. Carefully comparing the value of different redemption options before making a decision is critical to avoiding these pitfalls.

Redemption Process Flowchart

A simple flowchart illustrating a typical rewards program redemption process might look like this:[Imagine a flowchart here. The flowchart would start with “Choose Redemption Option” branching to “Travel,” “Merchandise,” and “Cash Back.” Each branch would then have subsequent steps: For Travel: “Search Flights/Hotels,” “Select Booking,” “Confirm with Points”; For Merchandise: “Browse Catalog,” “Select Item,” “Confirm with Points”; For Cash Back: “Select Cash Back,” “Specify Amount,” “Confirm Redemption.” All branches would then converge at “Redemption Complete.”]

Program Fees and Terms

Understanding the fees and terms associated with credit card rewards programs is crucial for maximizing benefits and avoiding unexpected costs. While rewards can be enticing, overlooking the fine print can significantly impact your overall financial picture. This section will examine various fee structures and key contractual elements to ensure informed decision-making.

Annual Fees and Other Associated Costs

Annual fees vary widely across different credit card rewards programs. Some premium cards with extensive travel benefits may charge several hundred dollars annually, while others, particularly those geared towards building credit, may have no annual fee. Other associated costs can include balance transfer fees, cash advance fees, and late payment fees. These fees can quickly erode the value of earned rewards if not carefully managed.

For example, a card with a $500 annual fee might require you to accrue a significant amount of rewards points just to offset the cost. Consumers should compare annual fees against the potential rewards earned to determine if the program aligns with their spending habits and financial goals.

Impact of Foreign Transaction Fees on Travel Rewards Programs

Foreign transaction fees are percentage-based charges levied on transactions made in a foreign currency. These fees can significantly reduce the value of rewards earned on travel cards, particularly for individuals who frequently travel internationally. A typical foreign transaction fee might be 3% of the transaction amount. On a $1,000 purchase, this would represent a $30 fee. This seemingly small percentage can quickly add up over multiple purchases, negating the value of accumulated rewards points.

Therefore, when choosing a travel rewards card, it is vital to identify cards that waive foreign transaction fees, allowing for maximized rewards redemption during international travel.

Examples of Credit Card Agreements and Key Terms

Credit card agreements are legally binding contracts outlining the terms and conditions of the cardholder agreement. Key terms related to rewards programs typically include the points accrual rate (e.g., 2x points on travel purchases), the expiration policy for accumulated points (points may expire after a certain period of inactivity), and the redemption options (e.g., travel, cash back, merchandise). Furthermore, the agreement will detail the process for earning and redeeming rewards, including any limitations or restrictions.

For example, a clause might specify a minimum point threshold for redemption or restrictions on the types of travel that points can be used for. Carefully reviewing these agreements is essential to understand the limitations and ensure alignment with individual needs and expectations. Failure to do so can lead to disappointment or unexpected costs.

Illustrative Examples of Rewards Programs: Credit Card Rewards Programs Compared And Contrasted

Understanding the nuances of different rewards programs requires examining real-world examples. This section details three distinct programs, highlighting their unique features and illustrating potential user experiences. Each example showcases how rewards are earned and redeemed, offering a practical understanding of program mechanics.

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is known for its flexible points system and strong travel benefits. Cardholders earn 5x points on travel purchased through Chase Ultimate Rewards®, 3x points on dining and online grocery purchases (excluding Target, Walmart, and wholesale clubs), and 1x point on all other purchases. These points can be redeemed for travel through the Chase Ultimate Rewards portal at a value of 1.25 cents per point, or transferred to various airline and hotel partners.A hypothetical user, Sarah, spends $3,000 on travel through the Chase Ultimate Rewards portal in a year.

This earns her 15,000 points (3,000 x 5). She also spends $2,000 on dining, earning 6,000 points (2,000 x 3). Her total points earned are 21,000. Redeeming these points for travel through the portal gives her a value of $262.50 (21,000 points x $0.0125/point). Alternatively, she could transfer her points to a partner airline for potential higher value depending on the redemption.

The annual fee of $95 needs to be considered when calculating the net value.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card offers a straightforward approach to earning and redeeming rewards. Cardholders earn 2 miles per dollar spent on all purchases. These miles are then redeemed for travel at a fixed value of one cent per mile. The simplicity of the program makes it easy to understand and use.Imagine John, who uses his Capital One Venture card for all his expenses, totaling $15,000 annually.

He earns 30,000 miles (15,000 x 2). He can redeem these miles for $300 worth of travel (30,000 miles x $0.01/mile). The card has an annual fee of $95, affecting the net reward value. While less flexible than point transfer programs, its simplicity and consistent value make it attractive for those prioritizing ease of use.

American Express® Gold Card

The American Express® Gold Card is geared towards food enthusiasts. Cardholders earn 4x points on purchases at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1x), 4x points at restaurants worldwide, and 3x points on flights booked directly with airlines or on amextravel.com. Points can be redeemed for travel, merchandise, or statement credits.Let’s consider Emily, a foodie who spends $6,000 annually at restaurants and $3,000 at supermarkets.

She earns 24,000 points from restaurants (6,000 x 4) and 12,000 points from supermarkets (3,000 x 4), totaling 36,000 points. Assuming a value of approximately 1 cent per point for statement credits, Emily could receive a $360 statement credit. The annual fee is $250, impacting the net benefit. The value of the points can fluctuate depending on the redemption method chosen.

Ultimately, the best credit card rewards program is highly individual, depending on spending patterns and financial priorities. By carefully weighing annual fees, rewards rates, redemption options, and understanding the impact of credit history, consumers can strategically leverage these programs to their advantage. This comparative analysis provides the foundation for making informed decisions and maximizing the value of credit card rewards.

Expert Answers

What is the impact of late payments on my rewards program?

Late payments can negatively impact your credit score, potentially affecting your eligibility for future rewards programs or even resulting in the cancellation of your existing card.

Can I transfer points or miles between different rewards programs?

Some programs allow point or mile transfers to partner programs, but this often involves limitations and fees. Check your program’s specific terms and conditions.

What happens to my rewards if I cancel my credit card?

The policy varies by issuer. Some may allow you to retain your points for a limited time, while others may forfeit them upon cancellation. Review your cardholder agreement.

Are there any tax implications for credit card rewards?

Generally, rewards redeemed for cash back are considered taxable income. The tax implications for other redemption options vary; consult a tax professional for specific guidance.