Credit card debt management strategies for small business owners

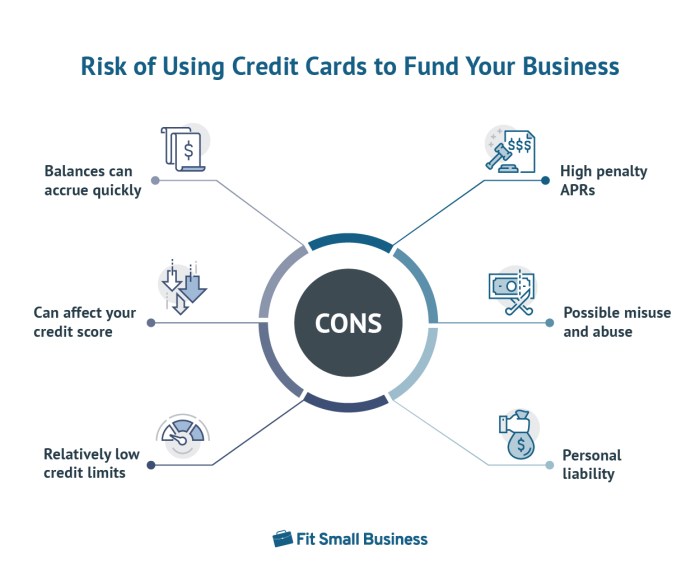

Credit card debt management strategies for small business owners are crucial for sustained growth and profitability. Navigating the complexities of business finance often leads to reliance on credit cards, but uncontrolled spending can quickly spiral into a crippling debt burden. This guide explores practical strategies to alleviate existing debt, improve financial management, and prevent future…