The risks and rewards of using credit cards for business capital

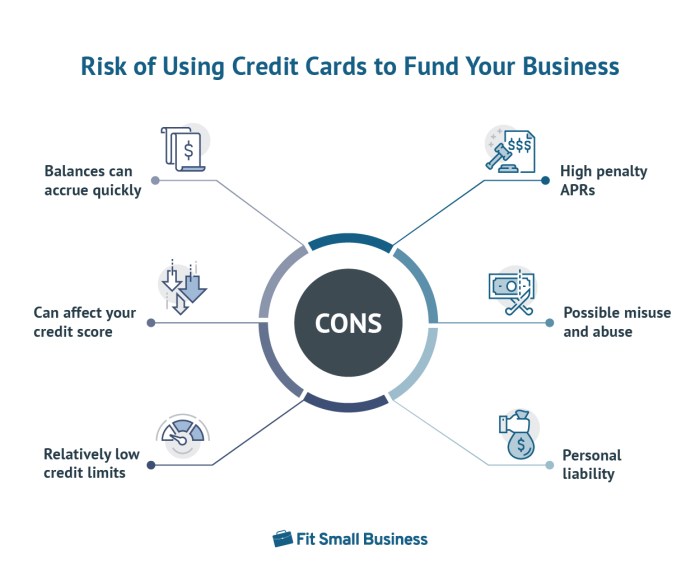

The risks and rewards of using credit cards for business capital are a critical consideration for any entrepreneur. While credit cards offer a readily accessible source of short-term funding, potentially boosting cash flow and enabling immediate purchases, they also carry the significant risk of accumulating substantial debt and damaging credit scores if not managed prudently….