Finding the Best Business Credit Card for Managing Expenses

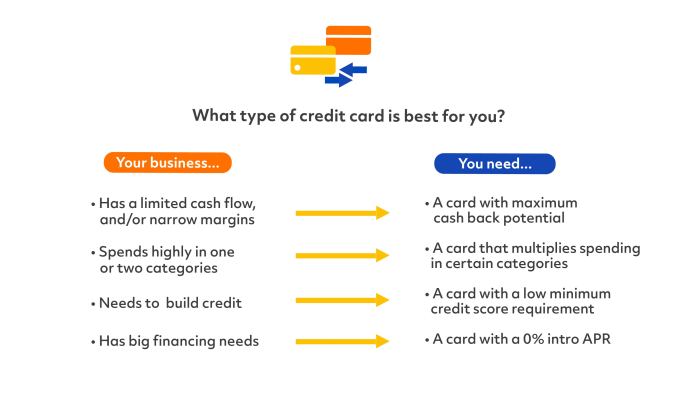

Finding the best business credit card for managing business expenses is crucial for optimizing financial health and maximizing rewards. Smart selection can significantly impact your bottom line, transforming mundane expenses into opportunities for growth. This guide navigates the complexities of choosing the right card, empowering you to make informed decisions that align with your business’s…